Can you trade in a financed car for a lease? If you’re curious about your options when it comes to trading in a car that you’re still making payments on, you’ve come to the right place! We know that navigating the world of car financing and leasing can be confusing, especially if you’re new to it. But don’t worry, we’re here to break it down for you in a simple and easy-to-understand way. So, let’s dive in and explore whether trading in a financed car for a lease is a possibility!

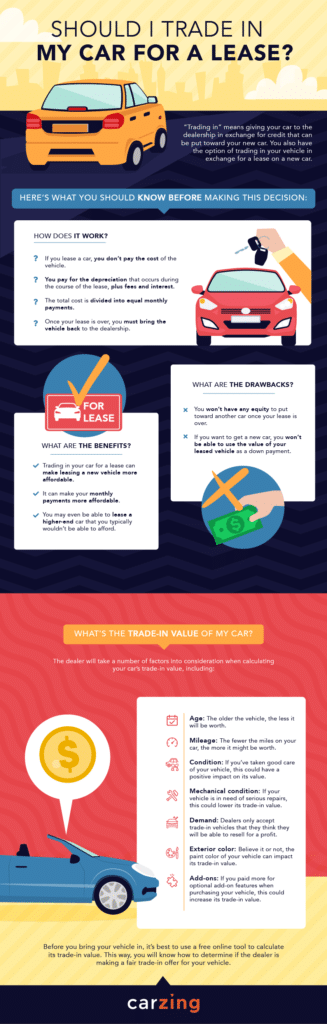

When it comes to trading in a financed car for a lease, there are a few factors to consider. First, let’s talk about what it means to trade in a car. When you trade in your car, it means that you’re using its value as a credit towards the purchase or lease of another vehicle. This can be a great way to offset the cost of your new car and potentially lower your monthly payments. However, trading in a financed car adds an extra layer of complexity to the equation.

If you still owe money on your current car loan, you’ll need to figure out the remaining balance and decide how to handle it. In some cases, if the trade-in value of your car is higher than the remaining balance on your loan, you can use the equity towards a lease. However, if the trade-in value is lower than what you owe, you’ll need to make up the difference. This could mean continuing to make payments on your old loan while also making payments on your new lease. It’s important to carefully evaluate your financial situation and discuss your options with a trusted advisor or dealership.

So, can you trade in a financed car for a lease? The answer is, it depends. It’s crucial to understand your specific circumstances, including the remaining balance on your loan and the trade-in value of your car. By doing your research and seeking professional guidance, you can make an informed decision that suits your financial goals. Remember, the car-buying process can be complex, but with the right information and support, you’ll be well-equipped to navigate it successfully!

Wondering if you can trade in a financed car for a lease? While it’s possible, there are a few things to consider. First, check the remaining balance on your car loan and the value of your vehicle. If the value is higher, you may have equity you can apply towards a lease. Next, contact your lender to discuss the trade-in process. Finally, reach out to a dealership that offers leasing options to explore your possibilities. Keep in mind that individual circumstances may vary, so it’s best to consult with professionals for personalized advice.

Can You Trade in a Financed Car for a Lease?

When it comes to car ownership, there are various options available, including financing or leasing a vehicle. Both options have their pros and cons, and individuals may find themselves wanting to switch from one to the other. But what if you currently have a financed car and want to lease instead? Can you trade in a financed car for a lease? In this article, we will delve into this topic and explore the possibilities and considerations involved.

1. Understanding Financing and Leasing

Before we delve into whether you can trade in a financed car for a lease, it’s essential to understand the fundamental differences between financing and leasing a vehicle. When you finance a car, you take out a loan to pay for the vehicle’s purchase. You make monthly payments, typically over a few years, until you fully own the car. On the other hand, when you lease a car, you essentially rent it for a set period, usually two to three years, and make monthly lease payments.

When you finance a car, you build equity in the vehicle as you pay off the loan. In contrast, when you lease a car, you don’t build equity, as you’re essentially paying for the vehicle’s depreciation during the lease term. This fundamental difference affects the possibilities and challenges of trading in a financed car for a lease.

Now that we have a basic understanding of financing and leasing, let’s explore whether it’s possible to trade in a financed car for a lease.

2. Assessing Your Loan Balance and Equity

One of the first considerations when trading in a financed car for a lease is the outstanding loan balance and equity in the vehicle. If you still owe a significant amount on your car loan, trading it in for a lease may not be financially feasible. Leasing companies typically require you to have a favorable equity position, meaning the value of the vehicle exceeds the remaining loan balance.

If you find yourself in this situation, it’s recommended to pay down your loan balance or wait until you have built enough equity in your car before considering a lease. Alternatively, you could explore other options, such as transferring your car loan to the lease or trading in your financed car for a different vehicle and then leasing the new one.

It’s important to note that the specific terms and conditions for trading in a financed car for a lease can vary depending on the leasing company, dealership, and your individual circumstances. Therefore, it’s advisable to consult with a financial advisor or the dealership to obtain accurate information and guidance.

3. Exploring Lease Assumption Options

In some cases, you may be able to explore lease assumption options when wanting to trade in a financed car for a lease. Lease assumptions occur when someone takes over the lease on your existing vehicle, effectively transferring the lease responsibility and payments to them. This option can be beneficial if you still have payments remaining on your financed car and want to switch to a lease sooner.

Lease assumptions allow you to be released from your current lease obligations, potentially freeing you up to pursue a new lease without waiting for your current financing terms to end. However, it’s important to note that not all leases are assumable, and the terms and conditions involved in lease assumptions can vary. It’s crucial to thoroughly understand the implications, costs, and requirements associated with lease assumptions before proceeding.

Additionally, lease assumptions can also vary from state to state, so it’s advisable to familiarize yourself with the specific regulations in your area. Consulting with a leasing company or financial advisor can also help you navigate through the process and determine if lease assumptions are a viable option for your situation.

4. Evaluating Costs and Budget Considerations

When considering trading in a financed car for a lease, it’s crucial to evaluate the costs and budget considerations involved. Leasing a vehicle may have different financial implications compared to financing. While lease payments are typically lower than loan payments, you need to consider other factors, such as mileage restrictions, maintenance costs, and potential lease-end charges.

It’s important to review the lease terms carefully and ensure they align with your needs and lifestyle. Analyze your budget and determine if the monthly lease payments, along with other associated costs, are affordable for you. Consider factors such as your anticipated annual mileage, as exceeding the mileage limit can result in additional charges at the end of the lease.

Taking the time to evaluate the costs and budget considerations before making the switch from a financed car to a lease can help you make an informed decision and avoid any financial strains.

5. Investigating Trade-in Values and Negotiating

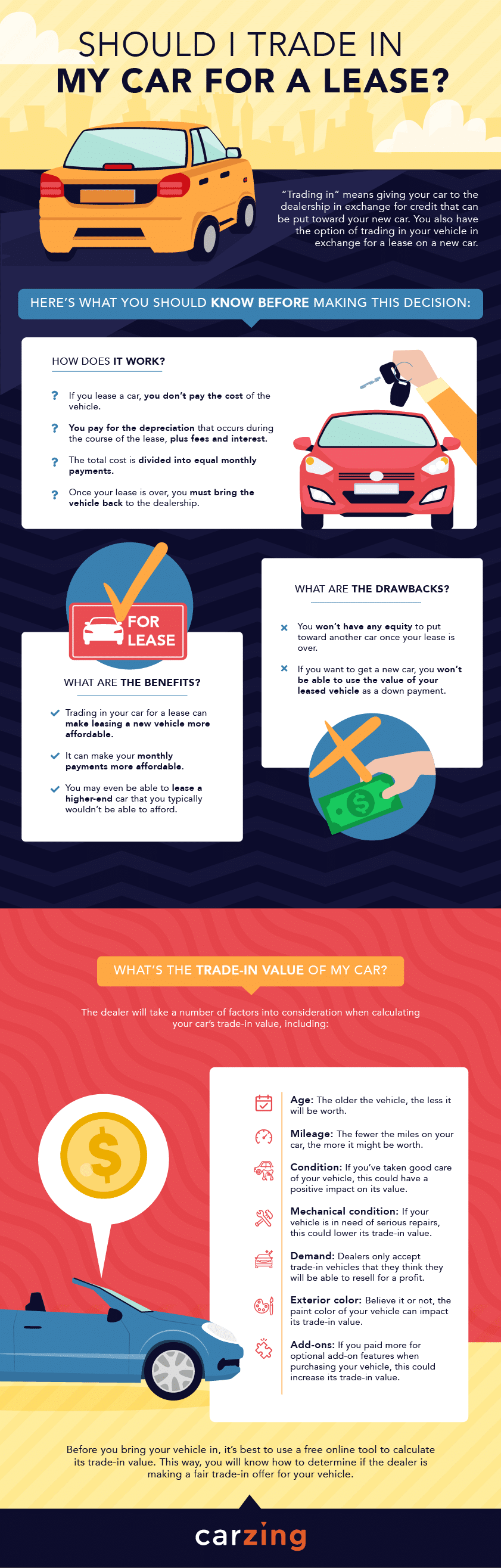

When trading in a financed car for a lease, it’s essential to investigate the trade-in values and negotiate the best possible deal. The trade-in value of your current vehicle can significantly impact the financial feasibility of transitioning from financing to leasing.

Research the current market value of your car and compare it to your remaining loan balance. If the trade-in value exceeds your loan balance, you may have equity that can be put towards your new lease. This equity can help offset any upfront costs or down payment requirements associated with the lease.

When negotiating a lease, it’s important to consider the vehicle’s purchase price, lease terms, interest rates, and any incentives or promotions offered by the dealership or leasing company. Taking the time to understand the intricacies of the negotiation process can help you secure a favorable lease deal that aligns with your financial goals and preferences.

6. Weighing the Pros and Cons

Before making the final decision to trade in a financed car for a lease, it’s crucial to weigh the pros and cons of each option. Financing and leasing both have their advantages and disadvantages, and what works for one person may not work for another.

Consider factors such as long-term ownership goals, budget, lifestyle, and preferences. Financing a car provides the opportunity to build equity and eventually own the vehicle outright. On the other hand, leasing offers lower monthly payments, the ability to drive a new car more frequently, and minimal maintenance responsibilities.

Take the time to assess your individual needs and priorities to determine which option aligns best with your circumstances. You may also wish to consult with a financial advisor to gain further insights and advice tailored to your specific situation.

7. Seeking Professional Advice

When considering the possibility of trading in a financed car for a lease, it’s always recommended to seek professional advice. Consulting with financial advisors, leasing companies, and reputable dealerships can provide you with the necessary guidance, insights, and accurate information to make an informed decision.

These industry professionals can help you navigate through the complexities of the process, understand the costs involved, explore available options, and ensure that you make a choice that aligns with your financial goals and circumstances.

Remember, while it is possible to trade in a financed car for a lease, it’s crucial to understand the implications, seek professional guidance, and thoroughly evaluate your financial situation and options before making any decisions.

Additional Information on Trading in a Financed Car for a Lease

Understanding the Process

Trading in a financed car for a lease involves several steps and considerations. To help you better understand the process and ensure a smooth transition, here are some additional details:

1. Early Termination Fees

If you’re considering trading in a financed car for a lease before the financing term ends, it’s important to inquire about any early termination fees. Dealerships or leasing companies may charge a fee to cover the costs associated with terminating the loan or lease agreement early. Understanding these fees can help you assess the financial feasibility of trading in your financed car for a lease.

2. Lease-End Options

When exploring the possibility of trading in a financed car for a lease, it’s essential to consider the lease-end options. Leasing agreements typically have various options at the end of the lease term, including the ability to purchase the vehicle, extend the lease, or trade it in for a new lease. Understanding these options can give you more flexibility and help you determine the best course of action.

3. Credit Score Considerations

Before transitioning from financing to leasing, it’s important to consider your credit score. Your credit score plays a significant role in lease approvals and can impact the terms and conditions of a lease, including interest rates and monthly payments. If your credit score has improved since you obtained financing for your car, you may be in a better position to secure favorable lease terms.

4. Lease Transfer Services

If you’re unable to trade in a financed car for a lease or don’t want to go through the lease assumption process, you may consider utilizing lease transfer services. These services connect individuals who want to transfer their leases with those looking for short-term lease options. It’s crucial to thoroughly research the company providing the service and understand any associated fees or requirements.

Expert Tips for Trading in a Financed Car for a Lease

When considering trading in a financed car for a lease, keep the following expert tips in mind:

- Review your current financing terms and assess your equity position before pursuing a lease.

- Consult with financial advisors or professionals who specialize in auto financing and leasing.

- Research and compare lease offers from different dealerships or leasing companies to secure the best possible deal.

- Thoroughly read and understand all lease terms and conditions, including mileage limits and end-of-lease responsibilities.

- Consider the long-term financial implications and your specific needs and preferences before making a final decision.

Ultimately, the decision to trade in a financed car for a lease depends on various factors, including your financial situation, goals, and lifestyle. By conducting thorough research, seeking professional guidance, and carefully evaluating your options, you can make an informed choice that aligns with your needs and preferences.

Key Takeaways: Can You Trade in a Financed Car for a Lease?

- 1. Trading in a financed car for a lease is possible, but it depends on your specific situation.

- 2. You may need to pay off the remaining balance on your car loan before trading it in for a lease.

- 3. Leasing typically offers lower monthly payments compared to financing a car.

- 4. Research and compare lease offers to find the best deal for your needs.

- 5. Consult with a reputable dealership or financial advisor to fully understand the implications of trading in a financed car for a lease.

Frequently Asked Questions

Can I trade in my financed car for a lease?

Yes, it is possible to trade in a financed car for a lease. When you trade in your financed car, the dealership will assess the value of the car and determine the amount owed on your loan. If the trade-in value is higher than the remaining loan balance, the dealership will pay off the loan and apply the difference towards your new lease. However, if the trade-in value is lower than the loan balance, you will be responsible for paying off the remaining amount.

What should I consider before trading in my financed car for a lease?

Before trading in your financed car for a lease, there are a few factors to consider. First, you should evaluate the trade-in value of your car and compare it to the remaining loan balance. If the trade-in value is significantly lower, you may need to make up the difference, which could impact your financial situation. Additionally, you should consider the terms and conditions of the lease, such as mileage limitations and wear and tear fees, to ensure they align with your driving habits and budget. It’s also important to research lease specials and incentives to find the best deal.

Can I trade in my financed car for a lease if I still have negative equity?

Yes, you can trade in your financed car for a lease even if you have negative equity. Negative equity occurs when the remaining loan balance is higher than the trade-in value of the car. In this situation, the dealership will still assess the trade-in value and apply it towards your new lease. However, the negative equity will be rolled into your new lease, increasing the overall cost. It’s important to carefully consider the financial implications of carrying negative equity into a new lease, as it may result in higher monthly payments or a longer lease term.

What are the advantages of trading in a financed car for a lease?

Trading in a financed car for a lease can have several advantages. First, you may be able to upgrade to a newer vehicle with the latest features and technology. Leasing also allows you to enjoy a lower monthly payment compared to financing a new car. Additionally, you won’t have to worry about depreciation or selling the car in the future. Leasing provides flexibility, as you can choose a new car every few years without the long-term commitment of owning a vehicle.

Are there any disadvantages to trading in a financed car for a lease?

While there are advantages to trading in a financed car for a lease, there are also some disadvantages to consider. One major drawback is that you won’t own the car at the end of the lease term, unlike financing where you eventually own the vehicle. Additionally, there may be mileage restrictions and wear and tear fees that can add extra costs. If you’re someone who likes to personalize your vehicle, leasing may not be the best option, as there are limitations on modifications. It’s important to weigh the pros and cons and consider your individual needs and preferences before making a decision.

Trade In My Car and Get a Lease?

Summary

So, can you trade in a financed car for a lease? Well, the answer is, it depends. It’s possible, but there are some things you need to consider. First, find out if you have positive equity in your current car. If you do, it can be used as a down payment towards your lease. However, if you owe more on your loan than the car is worth, you’ll have negative equity, which can make things tricky. In that case, you’ll likely have to roll the remaining loan balance into your new lease, which will make your monthly payments higher. Additionally, you’ll need to check if your lender allows lease transfers or early buyouts. Some lenders have restrictions on these options, which could further complicate the process.

If you decide to move forward with trading in your financed car for a lease, make sure to carefully read the terms and conditions of your new lease. Understand how much you’ll be paying each month, including any additional fees or charges. Remember, trading in a financed car for a lease can be a convenient option, but it’s important to consider all the financial implications and make sure it’s the right choice for you.