Can You Finance a Barndominium?

If you’ve ever dreamt of living in a unique, rustic-meets-modern home, then a barndominium might just be the perfect fit for you. But here’s the big question: can you finance a barndominium? Well, buckle up because we’re about to dive into all the juicy details!

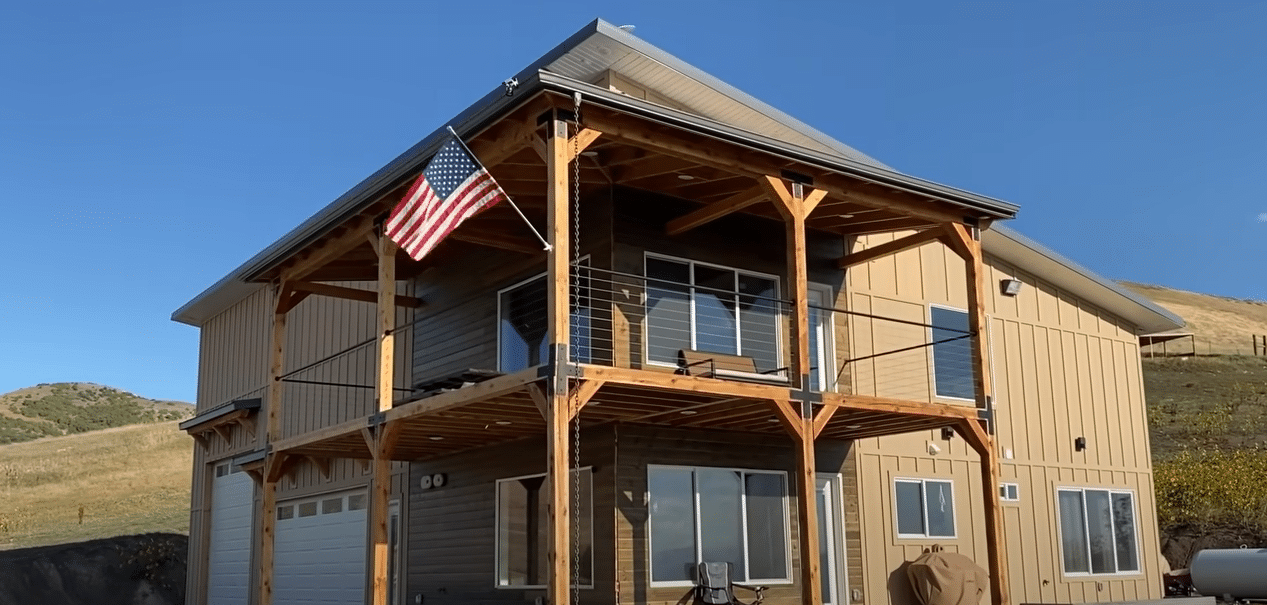

Now, you might be scratching your head and thinking, “Wait a minute, what exactly is a barndominium?” Don’t fret, my friend! A barndominium is a type of home that combines the best of both worlds: a barn-like structure with all the comforts of a traditional house. Picture this: an open floor plan, soaring ceilings, and plenty of space to unleash your inner architect.

But back to the main event – financing. The good news is that yes, you can indeed finance a barndominium. In fact, many lenders are embracing the growing popularity of these unique dwellings and offering financing options tailored specifically to barndominium enthusiasts like yourself. So, whether you’re dreaming of turning a barn into your forever home or building a barndominium from the ground up, there are financing solutions out there waiting for you.

So, if you’re ready to embark on a one-of-a-kind homeownership journey and make your barndominium dreams a reality, keep reading. We’re here to break it all down for you, from finding the right lender to navigating the financing process. Get your cowboy boots on, partner, because your barndominium adventure starts now!

Can You Finance a Barndominium?

Welcome to our comprehensive guide on financing barndominiums! If you’re considering building a barndominium, you might be wondering if you can secure financing for this unique type of home. In this article, we’ll explore the ins and outs of financing a barndominium, including the options available to you, the requirements you might need to meet, and the benefits of pursuing this type of financing. Read on to find out how you can make your dream barndominium a reality!

What is a Barndominium?

Before diving into financing options, let’s start by defining what a barndominium actually is. A barndominium is a type of home that combines the functionality of a barn with the comfort and amenities of a traditional house. Typically made from steel or metal, barndominiums offer a unique aesthetic and the flexibility to design the interior layout according to your specific needs. They have gained popularity in recent years due to their durability, energy efficiency, and versatility.

Financing Options for Barndominiums

When it comes to financing a barndominium, you have a few options to consider. Let’s explore each of these options in more detail:

Traditional Mortgages

One option for financing a barndominium is to secure a traditional mortgage through a bank or lending institution. While this can be a viable option, it’s important to note that not all lenders may be familiar with barndominiums and their unique construction. You may need to provide additional documentation and information to help the lender understand the value and potential of your barndominium.

Construction Loans

Another possibility is to obtain a construction loan specifically tailored for building a barndominium. With a construction loan, you can finance the cost of the construction phase, and once the project is complete, you can convert it into a traditional mortgage. These loans often offer more flexibility in terms of repayment options and can be a suitable choice if you’re building your barndominium from scratch.

Personal Loans

If you’re unable to secure a traditional mortgage or construction loan, you may consider obtaining a personal loan to finance your barndominium. Personal loans typically come with higher interest rates and shorter repayment terms, but they can be a good option if you have a strong credit history and a solid financial standing.

Owner Financing

In some cases, you might be able to negotiate owner financing with the seller of the barndominium property. This means that instead of going through a traditional lending institution, you make payments directly to the seller. Owner financing can provide more flexibility in terms of credit requirements and down payments, but it’s important to thoroughly review and understand the terms of the agreement before proceeding.

Considerations for Financing

When seeking financing for your barndominium, there are a few key considerations to keep in mind:

1. Property Appraisal and Insurance

Since barndominiums are a relatively new concept, finding an appraiser who is familiar with valuing these properties might be a challenge. It’s essential to work with an appraiser who understands the value and potential of barndominiums to ensure accurate valuation. Additionally, finding an insurance provider that offers coverage for barndominiums is crucial, as not all insurance companies may offer policies specifically tailored for this type of home.

2. Credit Score and Financial History

Your credit score and financial history will play a significant role in determining your eligibility for financing a barndominium. Lenders will typically review your credit score, income, debt-to-income ratio, and other financial factors to assess your ability to repay the loan. It’s essential to maintain a good credit score and address any outstanding issues on your credit report before applying for a loan.

3. Down Payment and Additional Costs

When financing a barndominium, be prepared to make a down payment as required by the lender or seller. The down payment is typically a percentage of the total cost of the property and can range from 5% to 20%. In addition to the down payment, you may also need to cover other costs such as closing fees, insurance premiums, and any necessary permits or inspections.

Benefits of Financing a Barndominium

Now that we’ve looked at the financing options available, let’s explore some of the benefits of financing a barndominium:

1. Customization and Flexibility

One of the main advantages of barndominiums is the ability to customize the interior layout and design according to your preferences. From open floor plans to unique room configurations, you have the flexibility to create a living space that suits your needs. Financing a barndominium allows you to build the home of your dreams without compromising on your vision.

2. Energy Efficiency

Barndominiums are known for their energy efficiency due to their metal or steel construction. These materials provide excellent insulation, reducing the energy required to heat or cool the home. This can lead to significant savings on utility bills over time and a more sustainable living environment.

3. Durability and Low Maintenance

Barndominiums are incredibly durable and require minimal maintenance compared to traditional homes. The steel or metal construction is resistant to weather conditions, pests, and fire, offering peace of mind and long-term cost savings. Financing a barndominium allows you to invest in a low-maintenance home that will stand the test of time.

Conclusion

Financing a barndominium can be an excellent option for those seeking a unique and customizable living space. Whether you opt for a traditional mortgage, construction loan, personal loan, or owner financing, it’s important to consider the requirements and benefits associated with each option. Remember to consult with professionals in the field and thoroughly review all terms and conditions before making a decision. With the right financing, you can turn your barndominium dreams into a reality!

Key Takeaways: Can You Finance a Barndominium?

- Barndominiums can be financed, but it can be more challenging than traditional homes.

- Some lenders may consider barndominiums as unconventional properties, affecting loan options and interest rates.

- Research different lenders who specialize in barndominium financing to find the best rates and terms.

- Consider working with a local bank or credit union that understands the unique aspects of barndominium financing.

- Be prepared to provide additional documentation and a larger down payment compared to traditional home financing.

Frequently Asked Questions

Are you considering financing a barndominium? We’ve got you covered. Here are some common questions and answers to help you navigate the process.

Can I get a traditional mortgage for a barndominium?

Getting a traditional mortgage for a barndominium can be challenging. Most barndominiums are considered non-traditional structures, which makes it difficult to find lenders who specialize in financing them. However, some lenders do offer specialized loans for barndominiums, so it’s worth exploring your options. Keep in mind that the terms and requirements for these loans may be different from traditional mortgages.

If you’re unable to secure a traditional mortgage, you may need to consider alternative financing options such as a construction loan or a personal loan to build your barndominium. It’s important to consult with lenders who understand barndominiums to get the best advice on financing your unique property.

What factors do lenders consider when financing a barndominium?

Lenders consider several factors when financing a barndominium. The first is the location of the property. The value and demand for barndominiums can vary depending on the location, which can affect the loan terms. Lenders will also assess the overall condition and quality of the construction. If the barndominium is well-built and meets all the necessary codes and regulations, it may increase your chances of securing financing at favorable terms.

Your credit score and financial history will also play a role in the lender’s decision. A higher credit score and a stable income will make you a more attractive borrower. Additionally, lenders may want to see a detailed plan for the barndominium construction, including the estimated costs and timeline. Providing comprehensive documentation and working with a lender experienced in barndominium financing can increase your chances of approval.

Can I refinance my existing loan to finance a barndominium?

Refinancing an existing loan to finance a barndominium is possible, but it depends on your specific situation and the loan terms. If you have sufficient equity in your current property, you may be able to refinance and use the cash-out to finance the barndominium construction. This option allows you to take advantage of the lower interest rates and longer repayment terms that come with refinancing.

However, it’s essential to carefully consider your financial situation before deciding to refinance. Consider the costs associated with refinancing, such as closing fees and potential prepayment penalties. It’s also crucial to assess whether the new loan’s terms will be beneficial in the long run. Consulting with a financial advisor or a mortgage specialist can help you determine if refinancing is the right choice for you.

Do I need to have a contractor lined up before applying for financing?

Having a contractor lined up before applying for financing is not always necessary, but it can be beneficial. Some lenders may require you to provide the details of your contractor as part of the loan application process. They may want to verify that the construction will be done by a licensed and reputable professional.

Even if it’s not a requirement, having a contractor in place can help streamline the loan approval process. The contractor can provide estimates and plans that demonstrate the feasibility and cost of the barndominium construction. This information will be valuable to the lender when evaluating your loan application. Additionally, having a trusted contractor can give you peace of mind throughout the building process, ensuring that the project runs smoothly from start to finish.

Are there any specific loan programs available for barndominium financing?

While traditional mortgages may not be readily available for barndominiums, there are specialized loan programs designed for this type of property. These programs cater to the unique financing needs of barndominiums and offer flexible terms and competitive rates.

One example of a specialized loan program is the construction loan. This loan provides funding for the construction of a barndominium and then converts into a mortgage once the construction is complete. Another option is getting a personal loan, which can be used to finance the construction costs. It’s important to research and explore different loan programs to find the one that best suits your financial situation and barndominium needs.

FINANCING Your BARNDOMINIUM | Loan For Your Barndominium

Summary

So, can you finance a barndominium? The answer is yes! While traditional lenders may have restrictions, there are alternative financing options available. It’s important to do your research, find a lender familiar with barndominiums, and have a solid plan in place. With the right approach, turning your barn into a cozy home is within reach. Good luck!