Looking to learn how to calculate profit on a Trailing Down Bot? Well, you’ve come to the right place! In this guide, we’ll break down the process step by step, making it easy to understand. So, let’s dive in and unravel the mystery of calculating profit on a Trailing Down Bot together!

First things first, let’s clarify what a Trailing Down Bot is. It’s a trading bot that helps investors make profits in a falling market. Now, calculating the profit on a Trailing Down Bot involves considering several factors including the initial investment, the current market price, and the trailing stop-loss percentage.

To put it simply, the profit on a Trailing Down Bot is determined by subtracting the initial investment from the current market value, taking into account the trailing stop-loss percentage. This calculation enables investors to assess their return on investment and make informed decisions. So, buckle up, and let’s explore the exciting world of calculating profit on a Trailing Down Bot together!

- Identify the initial investment amount.

- Determine the percentage decrease in value of the investment.

- Calculate the new value of the investment after the decrease.

- Subtract the new value from the initial investment to get the profit.

- Divide the profit by the initial investment and multiply by 100 to get the profit percentage.

With these steps, you can accurately calculate the profit on a trailing down bot without any hassle.

How to Calculate Profit on a Trailing Down Bot?

Calculating profit on a trailing down bot can be a complex process, but with the right knowledge and tools, it can be done effectively. In this article, we will dive into the details of how to calculate profit on a trailing down bot, step by step. Whether you are a beginner or an experienced trader, understanding how to calculate your profit is crucial for making informed decisions and maximizing your gains. So, let’s get started!

Understanding Trailing Down Bots

A trailing down bot is an automated trading program that is designed to follow the price of an asset as it declines. This type of bot is commonly used in the cryptocurrency market, where prices can be highly volatile. Trailing down bots aim to sell an asset at a higher price than its current value, allowing traders to profit from downward price movements.

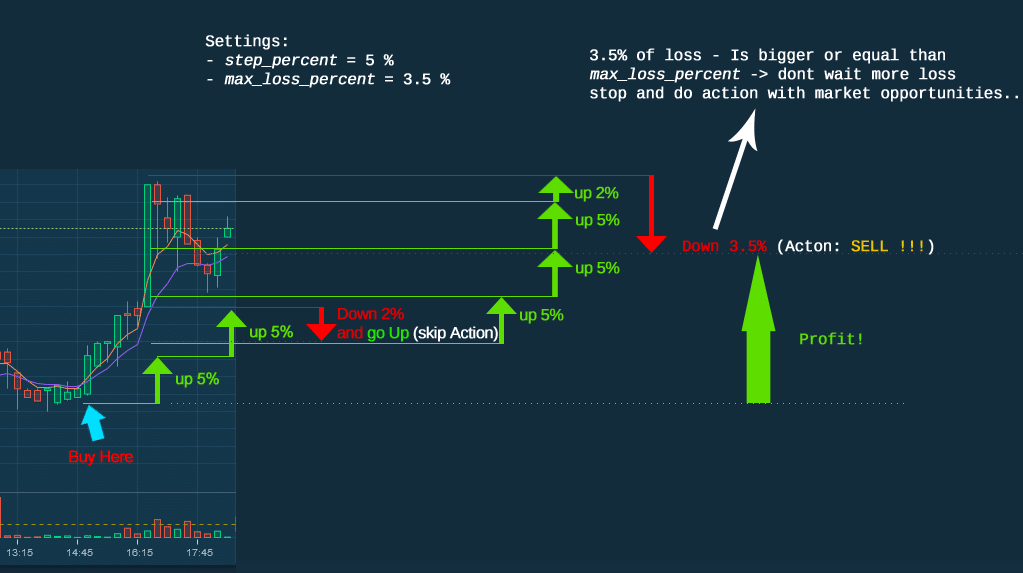

To calculate profit on a trailing down bot, it is important to understand how these bots work. They typically use trailing stop orders, which adjust the sell price as the asset price decreases. This allows the bot to capture potential gains as the price falls and ensures that the asset is sold at the best possible price.

In order to calculate profit on a trailing down bot, you need to consider factors such as the purchase price, the sell price, fees, and the trailing stop percentage. By analyzing these variables, you can determine your potential profit and make informed decisions about your trades.

Calculating Profit on a Trailing Down Bot

Now that we have an understanding of trailing down bots, let’s dive into the process of calculating profit. Here are the steps to follow:

- 1. Determine the purchase price: The purchase price is the price at which you bought the asset. This is the starting point for calculating your profit.

- 2. Set the trailing stop percentage: The trailing stop percentage determines the point at which the bot will sell the asset. This is typically calculated based on a percentage of the current price.

- 3. Calculate the sell price: The sell price is derived from the trailing stop percentage. It will adjust as the price decreases, capturing potential gains.

- 4. Consider trading fees: Trading fees are charges by the exchange for executing trades. Take these fees into account when calculating your profit.

- 5. Calculate profit: Once you have the sell price and the purchase price, you can calculate your profit by subtracting the purchase price, the fees, and the trailing stop percentage.

It is important to note that calculating profit on a trailing down bot is not a guarantee of actual profit. Market conditions can change rapidly, and trading fees and other factors can impact your overall profitability. Therefore, it is essential to continuously monitor your trades and make adjustments as necessary.

Tips for Maximizing Profit on a Trailing Down Bot

While calculating profit is important, there are also several strategies that can help maximize your gains when using a trailing down bot. Here are some tips to consider:

- 1. Set realistic trailing stop percentages: Setting the right trailing stop percentage can help you capture gains without selling too early. It is important to strike a balance and consider the volatility of the asset.

- 2. Stay informed about market trends: Keeping up with market trends and news can help you make more informed decisions about when to buy and sell. This information can be invaluable when setting your trading strategy.

- 3. Monitor and adjust your bot settings: Trailing down bots require active monitoring and adjustment. Analyze your trades regularly and make changes to your bot settings as needed to optimize your profit potential.

- 4. Diversify your portfolio: Instead of relying solely on trailing down bots, consider diversifying your portfolio with other trading strategies. This can help mitigate risk and increase overall profitability.

By following these tips and staying vigilant, you can increase your chances of maximizing profit on a trailing down bot.

Additional Information: How to Choose the Right Trailing Down Bot?

Choosing the right trailing down bot is crucial for successful trading. Here are three key factors to consider when selecting a bot:

1. Ease of Use

Look for a trailing down bot that is user-friendly and allows for easy configuration. A bot with a simple interface and clear instructions can save you time and frustration.

2. Features and Customization

Consider the features and customization options offered by the bot. Some bots allow you to set specific parameters and rules, while others have more advanced features like backtesting and multiple trading strategies.

3. Reputation and Support

Research the reputation of the bot and the team behind it. Look for user reviews and testimonials to gauge its effectiveness and reliability. Additionally, check if the bot offers customer support in case you encounter any issues or need assistance.

Conclusion

Calculating profit on a trailing down bot is a crucial aspect of successful trading. By considering factors such as the purchase price, sell price, fees, and trailing stop percentage, you can determine your potential profit and make informed decisions. Additionally, by following tips for maximizing profit and choosing the right trailing down bot, you can increase your chances of success in the market. Remember to continually monitor your trades and adjust your bot settings as needed to optimize your profitability. Happy trading!

Frequently Asked Questions

Are you curious about how to calculate profit on a trailing down bot? Look no further! Here are answers to some commonly asked questions to help you understand the process.

How does a trailing down bot work?

A trailing down bot is a trading bot used in the stock market. It is designed to automatically sell a stock at a predetermined percentage below its highest price since purchase. This allows investors to maximize their profits by capitalizing on upward price movements while protecting against potential losses. The trailing stop order adjusts dynamically as the stock price increases, trailing it down by the set percentage.

For example, if you set a trailing stop order at 5% below the highest price, and the stock reaches $100, the sell order will be triggered if the price drops to $95 or below. However, if the stock price continues to rise, the trailing stop order will also rise accordingly.

How do I calculate profit on a trailing down bot?

To calculate the profit on a trailing down bot, you need to determine the selling price and deduct the total cost of acquiring the stock. The total cost includes the initial purchase price and any additional costs such as fees or commissions.

Once you have the selling price and the total cost, simply subtract the total cost from the selling price to get the profit. This profit represents the amount you have made from the trading activity using the trailing down bot. Keep in mind that this calculation does not take into account any taxes or other expenses you may incur.

What factors can affect the profit on a trailing down bot?

Several factors can impact the profit on a trailing down bot. First and foremost, the performance of the stock itself will greatly influence the profit. If the stock price increases significantly before the trailing stop order is triggered, the profit will be higher compared to a stock that experiences a smaller price increase.

Additionally, the percentage set for the trailing stop order can also affect the profit. A smaller percentage will trigger the sell order sooner, potentially resulting in a lower profit. On the other hand, a larger percentage may provide more room for the stock to increase in value, increasing the potential profit. Other factors such as market volatility and trading fees should also be considered.

Can I adjust the profit calculation on a trailing down bot?

Yes. The profit calculation on a trailing down bot can be adjusted based on your specific preferences and trading strategy. You can customize the percentage for the trailing stop order to determine when the sell order will be triggered. By adjusting this percentage, you can potentially increase or decrease the profit depending on your risk tolerance and market expectations.

It’s important to note that while adjusting the profit calculation can offer more control, it also comes with potential risks. A higher percentage may allow for greater profit potential, but it also increases the likelihood of the trailing stop order being triggered prematurely. It’s essential to carefully analyze and monitor the market conditions to make informed decisions about profit calculation adjustments.

Are there any limitations or risks associated with calculating profit on a trailing down bot?

Like any investment strategy, there are limitations and risks to consider when calculating profit on a trailing down bot. One limitation is that the profit calculation only considers the difference between the selling price and the total cost, without factoring in taxes or other expenses.

Moreover, the stock market is unpredictable, and the trailing stop order may not always capture the optimal profit. The stock’s price can experience sudden drops that bypass the trailing stop order, resulting in potential losses. It’s essential to have a comprehensive understanding of the bot’s functionality and market conditions to mitigate risks and make well-informed decisions.

Trailing Take Profit Explained – TradeSanta

Summary

Calculating profit on a trailing down bot is easier than you might think. First, determine your initial investment. Then, subtract your total expenses from your total revenue to find your profit. Remember to consider fees and taxes. Keep an eye on your trailing down bot and adjust your strategy as necessary to maximize your profit. Happy trading!

In conclusion, by following these simple steps, you can easily calculate the profit on a trailing down bot. With a little attention and a smart strategy, you’ll be on your way to growing your investment. Don’t forget to stay informed and adapt to market conditions. Good luck!