Picture this: you’ve just bought a used car and financed it, and now you’re wondering if you need full coverage for it. Well, fear not, my friend, because that’s exactly what we’re here to talk about: Do You Need Full Coverage on a Used Financed Car? Let’s dive in and find out!

Now, before we get into the nitty-gritty, let’s quickly go over what full coverage actually means. Spoiler alert: it’s not just about protecting your car from bumper to bumper. Full coverage typically includes two main components: liability coverage to protect others if you’re at fault in an accident, and physical damage coverage to protect your own car. But do you really need both on a used financed car?

Here’s the deal: while it’s not a legal requirement to have full coverage on a used financed car, it’s often strongly recommended by lenders. Why? Because they want to protect their investment (aka your car) in case of theft, accidents, or any unfortunate mishaps. So, you might want to seriously consider getting full coverage to ensure peace of mind for yourself and keep your lender happy too. With that being said, let’s weigh the pros and cons and help you make an informed decision. Exciting stuff, right? Let’s get cracking!

Do You Need Full Coverage on a Used Financed Car?

When it comes to owning and insuring a used financed car, many questions can arise. One common question that arises is whether or not you need full coverage on a used financed car. In this article, we will explore the factors that may influence your decision and provide you with the necessary information to make an informed choice.

Understanding Full Coverage Insurance

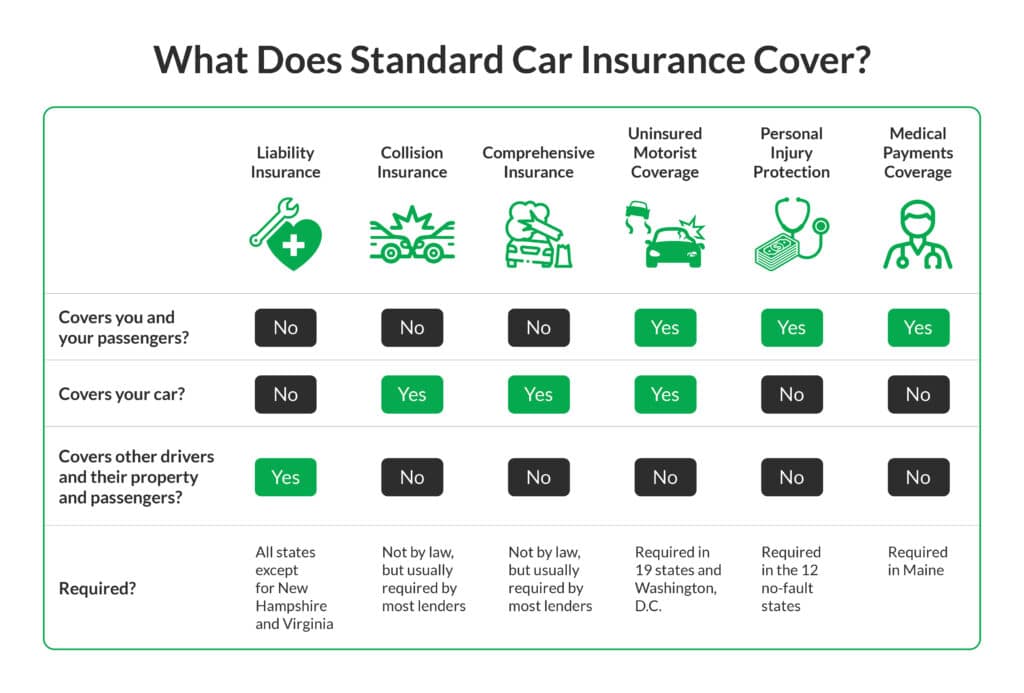

Before delving into the question of whether full coverage is necessary for a used financed car, it is important to understand what full coverage insurance entails. Full coverage insurance typically includes both comprehensive and collision coverage, in addition to the standard liability insurance required by law.

Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, fire, and natural disasters. Collision coverage, on the other hand, covers damage to your vehicle in the event of an accident. Both types of coverage are designed to protect you financially in the event of unexpected circumstances.

The Importance of Full Coverage Insurance

When considering whether or not to purchase full coverage insurance for your used financed car, it is important to consider the potential risks and benefits. While liability insurance is typically the minimum required by law, full coverage insurance provides additional protection for your vehicle and your finances.

One of the main benefits of full coverage insurance is that it can help cover the cost of repairing or replacing your vehicle in the event of an accident or other covered event. This can be particularly valuable if you rely on your car for transportation or if you have a high-value vehicle.

Additionally, having full coverage insurance can provide peace of mind knowing that you are financially protected in a wide range of scenarios. With comprehensive coverage, you are covered for events out of your control, such as theft or damage from a storm. Collision coverage ensures that you are protected in the event of an accident, regardless of who is at fault.

Factors to Consider

While full coverage insurance offers extensive protection, there are factors you should consider before making a decision. First and foremost, you should assess the value of your car. If your car is older or has a low market value, the cost of full coverage insurance may outweigh the potential benefits.

Next, consider your financial situation. Can you comfortably afford the additional premiums associated with full coverage insurance? Assessing your budget and financial priorities is essential before committing to full coverage.

Finally, consider any additional requirements or recommendations set forth by your lender. In some cases, lenders may require full coverage insurance to protect their financial interest in the vehicle. Review your financing agreement and consult with your lender to determine if full coverage is a requirement.

Tips for Finding the Right Coverage

- Research and compare quotes from multiple insurance providers to ensure you are getting the best coverage at the most competitive rates.

- Consider increasing your deductibles to lower your premium costs, but only if you are comfortable paying a higher deductible if an incident occurs.

- Ask about any available discounts that may be applicable to your situation, such as safe driving discounts or discounts for bundling policies.

The Bottom Line

While full coverage insurance is not legally required for a used financed car, it can provide valuable protection and peace of mind. Assess your car’s value, your financial situation, and any lender requirements to make an informed decision. Ultimately, the choice is yours, but it is important to consider the potential risks and benefits carefully.

Additional Considerations for Insuring a Used Financed Car

Gap Insurance: Is it Necessary?

Gap insurance is another consideration when insuring a used financed car. Gap insurance covers the difference between what you owe on your car loan and the actual cash value of your car in the event of a total loss. This can be especially important when financing a used car, as depreciation can cause the value of your car to decline faster than your loan balance.

Gap insurance can be a valuable investment if you owe more on your car loan than your car is worth. It can protect you from financial loss in the event of a total loss, ensuring that you are not left with a significant amount of debt.

The Importance of Regular Maintenance

While insurance coverage is essential, it is also important to prioritize regular maintenance for your used financed car. Proper maintenance can help prevent accidents and keep your car running smoothly, reducing the likelihood of filing an insurance claim.

Regularly check the fluid levels, tire pressure, and brakes. Invest in routine oil changes, filter replacements, and inspections to address any potential issues before they become major problems. Taking care of your car can help extend its lifespan and reduce the likelihood of costly repairs.

Protecting Your Investment

In addition to insurance coverage and regular maintenance, there are steps you can take to protect your investment in a used financed car. Here are a few tips:

- Keep your car in a secure location, preferably in a locked garage, when not in use.

- Invest in security features such as car alarms and steering wheel locks to deter theft.

- Consider adding additional protection such as a tracking device to help locate your car in the event of theft.

- Install a dashcam to provide evidence in the event of an accident or dispute.

By taking these precautions, you can further safeguard your investment and mitigate potential risks.

Conclusion

When deciding whether or not to purchase full coverage insurance for a used financed car, there are several factors to consider. The value of your car, your financial situation, and any lender requirements should all be taken into account. While full coverage insurance provides extensive protection, it may not always be necessary or financially feasible. Ultimately, the choice is yours, but it is important to weigh the potential risks and benefits before making a decision. Additionally, considering factors such as gap insurance and regular maintenance can further protect your investment in a used financed car.+

Key Takeaways:

- Full coverage insurance is not legally required for a used financed car, but it is highly recommended to protect yourself and your investment.

- Full coverage insurance includes both collision and comprehensive coverage, providing financial protection for accidents, theft, and other damages.

- If you still owe money on your car loan, the lender may require you to have full coverage insurance to protect their financial interest in the car.

- Even if full coverage is not required, it can give you peace of mind knowing that your vehicle is protected against a wide range of potential risks.

- Comparing quotes from different insurance providers can help you find the best deal on full coverage insurance for your used financed car.

Frequently Asked Questions

When it comes to insuring a used financed car, there are several factors to consider. Here are answers to the most common questions regarding full coverage on a financed vehicle.

1. What does it mean to have “full coverage” on a used financed car?

Having “full coverage” on a used financed car typically means you have both comprehensive and collision coverage. Comprehensive coverage protects your car against non-collision related incidents like theft, vandalism, and natural disasters. Collision coverage, on the other hand, protects your car if it is involved in an accident with another vehicle or object.

When a car is financed, lenders typically require the borrower to have full coverage to protect their investment. This ensures that if the car is damaged or stolen, the lender can still recoup the remaining loan balance.

2. Is full coverage mandatory for a used financed car?

In most cases, yes, having full coverage is mandatory for a used financed car. Lenders require it as a condition of the loan to protect their financial interests. Additionally, many states have minimum insurance requirements that include both liability and physical damage coverage, which falls under the umbrella of full coverage.

However, it’s important to check the specific requirements of your lender and state to ensure compliance. Failing to have full coverage on a financed car can result in the lender considering the loan in default, leading to potential consequences such as repossession.

3. Can I choose to only have liability coverage on a used financed car?

No, in most cases, you cannot choose to have only liability coverage on a used financed car. Lenders typically require comprehensive and collision coverage as a condition of the loan to protect their investment. Liability coverage alone would not protect the lender’s interest if the car is damaged or stolen.

While it may be tempting to only have liability coverage to save on insurance costs, it’s essential to consider the potential financial consequences if something were to happen to the car without adequate coverage.

4. Can I modify the amount of coverage on a used financed car?

In some cases, you may be able to modify the amount of coverage on a used financed car, but it’s important to consult with both your lender and insurance provider before making any changes. The lender may have specific requirements for the minimum coverage amount, and modifying it without their approval could violate the terms of the loan agreement.

It’s also crucial to consider the value of the car and your personal financial situation when adjusting the coverage. While reducing coverage limits may lower insurance premiums, it could also leave you vulnerable to significant costs if an accident or other incident occurs.

5. What factors influence the cost of full coverage on a used financed car?

Several factors influence the cost of full coverage on a used financed car. These factors include your age, driving record, location, the make and model of the car, and the coverage limits you choose. Generally, younger drivers with less driving experience, a history of accidents or violations, and living in areas with high crime rates may have higher insurance premiums.

The make and model of the car also play a role, as more expensive or higher-performance vehicles typically come with higher insurance rates. Additionally, selecting higher coverage limits will increase the cost of insurance, as it provides more financial protection in the event of an accident or other incident.

Should I Keep Full Coverage on My Paid Off Car?

Summary

If you have a used car that you still owe money on, full coverage insurance is a good idea. It protects both you and the lender in case of damage or theft. However, if your car’s value is very low, you may not need as much coverage.

If you’re thinking of dropping full coverage, consider the risks and benefits carefully. Will you be able to cover the costs of repairs or a new car if something happens? It’s important to find the right balance between protection and affordability.