Welcome to the world of Bright Money—an exciting financial tool that’ll transform the way you manage your money! Wondering how does Bright Money work? Well, let me break it down for you in simple terms.

Picture this: Bright Money is like your digital money mentor, always by your side, helping you make smarter financial decisions. It combines the power of cutting-edge technology with expert insights to create a personalized plan that’s tailored just for you.

Here’s the deal: Bright Money analyzes your spending patterns, tracks your bills, and suggests ways to save more, all in real-time. It’s like having a financial wizard right in your pocket, guiding you towards financial well-being. And the best part? It’s super easy to use! So, get ready to take control of your finances and watch your funds flourish with Bright Money!

How Does Bright Money Work?

Introduction:

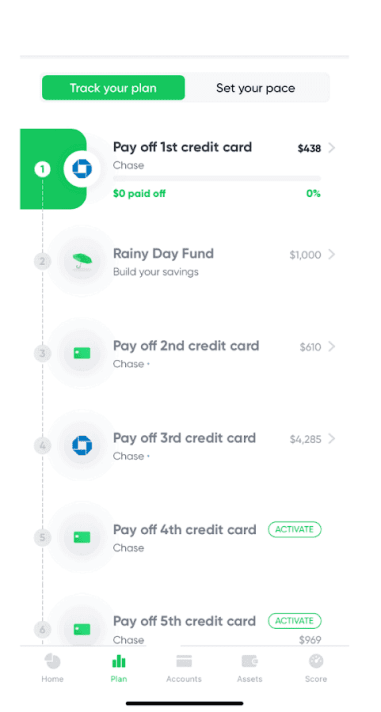

Bright Money is a financial management app that aims to help users improve their financial well-being and reduce debt. By using advanced algorithms and personalized recommendations, Bright Money offers insights and solutions to help users make smarter financial decisions. In this article, we will explore the different features and mechanisms that make Bright Money work.

1. Personalized Financial Dashboard

Bright Money starts by providing users with a personalized financial dashboard that gives them a holistic view of their financial situation. The dashboard integrates with users’ bank accounts, credit cards, and loans to gather real-time data and present it in an easy-to-understand format. Users can track their spending, income, and savings all in one place, making it convenient and efficient to manage their finances effectively.

The financial dashboard also categorizes transactions automatically, allowing users to see how much they are spending on different categories such as groceries, utilities, or entertainment. By analyzing spending patterns, Bright Money can provide insights and tips on how users can save money or reduce unnecessary expenses. This helps users gain a better understanding of their financial habits and identify areas where they can make improvements.

2. Intelligent Budgeting and Goal Setting

Bright Money goes beyond basic budgeting by leveraging artificial intelligence to create intelligent budgets based on users’ income, expenses, and financial goals. The app helps users set realistic budgets for different categories and provides recommendations on how to allocate their income effectively. It takes into account various factors such as recurring bills, upcoming expenses, and debt payments to ensure that users stay on track with their financial goals.

The app also allows users to set savings goals and tracks their progress over time. Bright Money analyzes users’ cash flow and spending patterns to identify opportunities for saving and sends personalized notifications to remind users of their goals. This feature helps users stay motivated and disciplined when it comes to saving money, ultimately improving their financial well-being in the long run.

3. Debt Management and Optimization

One of the key features of Bright Money is its focus on debt management. The app analyzes users’ existing debts, such as credit cards, loans, or mortgages, and provides recommendations on how to optimize payments and reduce interest costs. Bright Money uses algorithms to identify the most efficient payment strategies, such as debt consolidation or balance transfers, that can help users pay off their debts faster.

The app also offers personalized recommendations on how to manage credit card usage and improve credit scores. By analyzing users’ spending patterns, utilization rates, and payment history, Bright Money suggests strategies to optimize credit card usage and avoid common pitfalls that could negatively impact users’ creditworthiness.

In conclusion, Bright Money is a powerful financial management tool that combines advanced algorithms and personalized recommendations to help users improve their financial well-being. By providing a holistic view of their finances, offering intelligent budgeting and goal-setting features, and focusing on debt management and optimization, Bright Money equips users with the tools they need to make smarter financial decisions and achieve their financial goals.

Key Takeaways: How Does Bright Money Work?

- Bright Money is a financial app that helps you manage your money better.

- It uses artificial intelligence to analyze your spending habits and suggest ways to save.

- The app also offers a Bright Money Card, which combines all your credit and debit cards into one.

- With Bright Money, you can set financial goals and track your progress towards them.

- The app provides personalized insights to help you make smarter financial decisions.

Frequently Asked Questions

Welcome to Bright Money! We’re here to answer some commonly asked questions about how our platform works to help you manage your finances better.

1. How does Bright Money help me save money?

Bright Money uses artificial intelligence to analyze your spending patterns and identify areas where you can save money. By tracking your expenses and income, it creates a personalized plan to optimize your finances. The platform also provides insights and recommendations to make smarter financial decisions.

Additionally, Bright Money negotiates lower interest rates on credit cards and loans, saving you money on interest payments. It aims to help you eliminate high-interest debt faster, so you can achieve your financial goals sooner.

2. Is my financial information safe with Bright Money?

Absolutely! At Bright Money, the security of your financial information is our top priority. We use bank-level encryption and advanced security measures to protect your data. Our platform operates under strict privacy policies and is compliant with industry regulations.

Rest assured that your login credentials, account information, and transaction details are highly encrypted and securely stored. We understand the importance of keeping your financial information private and confidential.

3. How does Bright Money negotiate lower interest rates?

Bright Money partners with financial institutions to negotiate better interest rates on credit cards and loans for its users. By leveraging its expertise and strategic partnerships, Bright Money is able to secure lower interest rates, saving you money in the long run.

The negotiation process involves reaching out to your lenders on your behalf and advocating for improved terms. Bright Money analyzes your financial profile and payment history to present a strong case for lower rates. If successful, you will benefit from reduced interest charges on your debts.

4. Can I still use Bright Money if I have multiple financial accounts?

Absolutely! In fact, Bright Money is designed to support users with multiple financial accounts. Whether you have multiple bank accounts, credit cards, or loans, Bright Money’s platform consolidates all your accounts in one place for easy management and analysis.

You can link all your accounts securely to Bright Money and have a holistic view of your finances. This allows you to track your overall financial health, understand your spending habits across various accounts, and receive personalized recommendations to optimize your money management.

5. How does Bright Money create a personalized financial plan for me?

Bright Money uses machine learning algorithms to analyze your financial data and create a personalized financial plan. It takes into account factors such as your income, expenses, debt, and financial goals to develop a plan that suits your unique circumstances.

The platform identifies areas where you can save money, suggests budgeting strategies, and provides guidance on debt repayment. It also offers insights on how to build a robust savings plan and achieve your financial milestones. Bright Money’s personalized financial plan is tailored to help you make the most of your money and reach your financial objectives.

How Bright Money app works?

Summary

Bright Money helps you manage your money by analyzing your spending and suggesting ways to save.

With its AI-powered app, it tracks your transactions, categorizes your expenses, and provides personalized advice.

The goal is to help you make better financial decisions and reach your savings goals faster.

By partnering with different financial institutions, Bright Money also offers loans with lower interest rates.

You can consolidate your debt and pay it off sooner, saving money in the long run.

Overall, Bright Money is a helpful tool that empowers you to take control of your finances and build a brighter financial future.