If you’re looking to transfer money from your Cash App to your Chime account, you’ve come to the right place! In this guide, we’ll walk you through the steps to make this process quick and easy. So let’s dive in and learn how to transfer money from Cash App to Chime!

Transferring money between your accounts should never be a hassle. With Cash App and Chime, you have the convenience of moving funds from one account to another seamlessly. Whether you need to send money to a friend or simply shift funds between your own accounts, we’ll show you how to do it with a few simple steps.

Stay tuned as we break down each step, provide helpful tips, and guide you through the entire process from start to finish. By the end of this guide, you’ll have all the knowledge you need to smoothly transfer money from your Cash App to your Chime account. Let’s get started!

- Open the Cash App on your mobile device.

- Tap the ‘Banking’ tab at the bottom of the screen.

- Select ‘Cash Out’ and choose the amount you want to transfer.

- Choose ‘Chime’ as the destination bank.

- Enter your Chime account details and confirm the transfer.

Note: To transfer money from Cash App to Chime, follow these step-by-step instructions. Open the Cash App, tap the ‘Banking’ tab, select ‘Cash Out,’ choose the transfer amount, select ‘Chime’ as the bank, enter your Chime account details, and confirm the transfer.

How To Transfer Money From Cash App To Chime?

Cash App and Chime are two popular mobile banking apps that provide convenient and easy-to-use financial services. Being able to transfer money between these platforms can be a handy feature for those who utilize both apps. In this article, we will explore the step-by-step process of transferring money from Cash App to Chime, along with some important tips and considerations.

Step 1: Linking Your Cash App and Chime Accounts

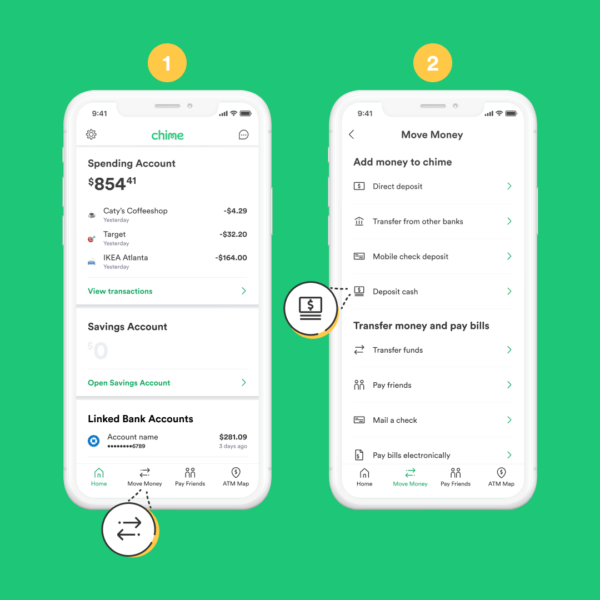

To begin the process of transferring money from Cash App to Chime, you first need to ensure that your accounts are linked. Open both apps on your mobile device and log in to each account using your credentials. In Cash App, navigate to the “Banking” or “Wallet” section and locate the “Add Chime Account” option. Follow the on-screen instructions to link your Chime account to Cash App. Once the accounts are successfully linked, you can proceed to the next step.

Security Tip: Enable Two-Factor Authentication

Before transferring money between the two platforms, it is important to prioritize security. Both Cash App and Chime offer two-factor authentication (2FA) as an additional layer of protection. Enable 2FA in both apps by going to the settings or security section. This will help safeguard your accounts and prevent unauthorized access.

Once your accounts are linked and 2FA is enabled, you can proceed with the money transfer process.

Step 2: Initiating the Transfer

In Cash App, locate the “Transfer” or “Send” option. You will be prompted to enter the recipient’s information, which in this case is your Chime account. Enter your Chime account details, including the account number and routing number. Take extra care to input the correct information to avoid any transfer errors or delays.

After verifying the details, enter the amount you wish to transfer from Cash App to Chime. Double-check the entered amount to ensure it is correct. Once you are satisfied, click on the “Confirm” or “Transfer” button to initiate the transfer.

Confirmation and Transfer Times

Upon confirming the transfer, Cash App will provide a confirmation screen displaying the transaction details. This includes the amount transferred, the recipient (Chime account), and any applicable fees. Review the details once again to ensure accuracy.

The time it takes for the transfer to complete can vary. Typically, transfers between Cash App and Chime can take anywhere from a few minutes to a few business days. Factors such as network congestion or processing delays may impact the transfer time. It is recommended to check both your Cash App and Chime accounts periodically to monitor the transfer status.

Step 3: Verifying the Transfer

Once the transfer is complete, you will receive a notification from both Cash App and Chime confirming the successful transaction. You can also check your Chime account balance to confirm that the transferred amount reflects accurately.

It is important to keep in mind any potential fees or limitations associated with transferring money between Cash App and Chime. Both platforms may have their own fee structures or transfer limits, so it is advisable to refer to their respective documentation or contact customer support for detailed information.

By following these steps and taking necessary precautions, you can seamlessly transfer money from Cash App to Chime and enjoy the benefits of these convenient banking apps.

Benefits of Using Cash App and Chime Together:

While it’s important to understand the process of transferring money between Cash App and Chime, it’s also worth highlighting the benefits of using these apps in synergy. Here are a few advantages of utilizing Cash App and Chime together:

Instant Fund Transfers:

Both Cash App and Chime offer instant fund transfers, allowing you to send and receive money within seconds. When linked together, you can take advantage of this feature and transfer funds seamlessly between the two apps.

No Monthly Fees:

Chime is known for its fee-free banking services, while Cash App also offers a range of services without monthly fees. By using both apps together, you can avoid unnecessary charges and enjoy cost-effective banking.

Budgeting and Savings Tools:

Chime offers various budgeting and savings tools, including round-up options and automatic savings. By transferring money from Cash App to Chime, you can utilize these features to manage your finances and save effectively.

Free ATM Access:

Chime offers a vast network of fee-free ATMs, and Cash App users can also benefit from participating ATMs. By combining both apps, you can enjoy easy access to cash without incurring unnecessary fees.

Using Cash App and Chime together can offer a comprehensive banking experience, combining the strengths of both platforms for your financial needs.

Tips for Transferring Money Between Cash App and Chime:

While the process of transferring money between Cash App and Chime is relatively straightforward, there are a few tips and considerations to keep in mind to ensure a smooth experience:

Double-Check Account Details:

Verify the account details you enter during the transfer process to avoid any errors. Even a small mistake in the routing number or account number can result in delays or failed transfers.

Monitor Transfer Status:

Keep an eye on the status of your transfer by checking both your Cash App and Chime accounts. This way, you can ensure that the transfer is completed successfully and address any issues promptly.

Be Aware of Transfer Limits:

Both Cash App and Chime may have transfer limits in place. Familiarize yourself with these limits to avoid any inconvenience or restrictions during the transfer process.

Contact Customer Support if Needed:

If you encounter any issues or have questions regarding your transfer, don’t hesitate to reach out to customer support for assistance. Cash App and Chime both offer responsive customer support to address any concerns you may have.

By following these tips, you can streamline the process of transferring money between Cash App and Chime and make the most of these convenient mobile banking apps.

Summary

Transferring money from Cash App to Chime can be a simple and efficient process when the necessary steps are followed. By linking your accounts, initiating the transfer, and monitoring the status, you can seamlessly move funds between the two platforms. Additionally, taking advantage of the benefits and tips mentioned in this article can enhance your overall banking experience. Remember to double-check account details, keep an eye on transfer limits, and reach out to customer support when needed. With Cash App and Chime working in conjunction, you can enjoy the convenience and ease of mobile banking while managing your finances effectively.

Key Takeaways: How To Transfer Money From Cash App To Chime?

- Transferring money from Cash App to Chime is a simple process.

- First, open the Cash App on your phone.

- Select the “Banking” tab and choose “Transfer to Bank.”

- Enter the amount you want to transfer and select your Chime account.

- Confirm the transfer and the money will be sent to your Chime account.

Frequently Asked Questions

Are you wondering how to effortlessly transfer money from Cash App to Chime? Look no further! We’ve got the answers to your burning questions right here.

1. Can I transfer money from my Cash App account to my Chime account?

Yes, you can easily transfer money from your Cash App account to your Chime account. Here’s how you can do it:

First, open the Cash App on your mobile device and locate the cash balance on the home screen. Tap on the “Cash & BTC” or “Banking” tab, depending on the app version. Next, select the “Cash Out” option and enter the desired amount you wish to transfer. Choose the “Standard” or “Instant” speed for the transfer, keeping in mind that there may be fees associated with the Instant option. Finally, confirm the transfer and wait for the money to be deposited into your Chime account, which typically takes 1-3 business days for the standard transfer.

2. Are there any fees involved in transferring money from Cash App to Chime?

It’s important to note that Cash App may charge fees for certain transactions, including transferring money from your Cash App to your Chime account. Here’s what you need to know:

If you choose the “Standard” speed for the transfer, Cash App does not charge any fees. However, if you opt for the “Instant” speed, there will be a fee of 1.5% of the transfer amount. It’s always a good idea to review the fee structure in the Cash App settings to get a clear understanding of any charges that may apply. Additionally, keep in mind that Chime may also have its own policies regarding incoming transfers and potential fees, so it’s worth checking with Chime as well.

3. Is there a maximum limit for transferring money from Cash App to Chime?

Yes, there are certain limits on how much money you can transfer from your Cash App to your Chime account. The exact limits may vary depending on factors such as account verification and transaction history. To find out your specific transfer limit, follow these steps:

Open the Cash App on your mobile device and tap on your profile icon in the top left corner. Next, scroll down and select “Limits & Fees.” Here, you’ll be able to view your specific transfer limits, including the maximum amount you can send in a single transfer or within a given time frame. If you have any additional questions or need to increase your transfer limit, it’s best to reach out to the Cash App support team for assistance.

4. How long does it take for the money to transfer from Cash App to Chime?

The time it takes for the money to transfer from Cash App to Chime may vary depending on the transfer speed you choose. Here’s a general timeline:

If you select the “Standard” speed for the transfer, it typically takes 1-3 business days for the money to be deposited into your Chime account. However, if you opt for the “Instant” speed, the transfer is usually completed within a matter of minutes. Keep in mind that while the Instant option provides faster access to funds, it does come with a 1.5% fee. If you need the money urgently, the Instant transfer may be worth considering, but if time is not of the essence, the Standard transfer will save you on fees.

5. What should I do if I encounter any issues during the transfer process?

If you experience any difficulties or encounter an issue while transferring money from Cash App to Chime, don’t worry. There are a few steps you can take to resolve the problem:

First, double-check that all the information you entered, such as the transfer amount and recipient’s account details, is correct. Even a small typo can cause a transfer to fail. If everything seems correct but the transfer still doesn’t go through, you can reach out to the Cash App support team for assistance. They will be able to investigate the matter further and provide you with a solution. Additionally, always ensure that you have a stable internet connection when initiating the transfer to avoid any technical glitches that may disrupt the process.

How to send money from Cash App to Chime – in a few clicks

Summary

Transferring money from Cash App to Chime is easy and convenient. Here are the key points:

First, link your Chime account to Cash App by adding your Chime account details. Then, on Cash App, go to the “My Cash” tab and tap on the “Cash Out” option. Select your Chime account and enter the amount you want to transfer. Confirm the transaction, and the money will be transferred to your Chime account instantly.

Remember to double-check the account details to avoid any errors. Also, note that there may be small fees for instant transfers. With these simple steps, you can easily transfer money from Cash App to Chime and manage your finances hassle-free!