Have you found yourself in a situation where you need to withdraw money from a permanently limited PayPal account? Don’t worry, we’ve got you covered! In this guide, we’ll walk you through the steps to successfully withdraw funds from your restricted PayPal account.

Getting access to your money when your PayPal account is permanently limited may seem challenging, but there are ways to navigate the process. We understand that it can be frustrating, but with the right knowledge and approach, you’ll be able to retrieve your funds and put them to good use.

So, if you’re ready to learn the ins and outs of how to withdraw money from a permanently limited PayPal account, let’s dive right in and get you on your way to accessing your hard-earned cash.

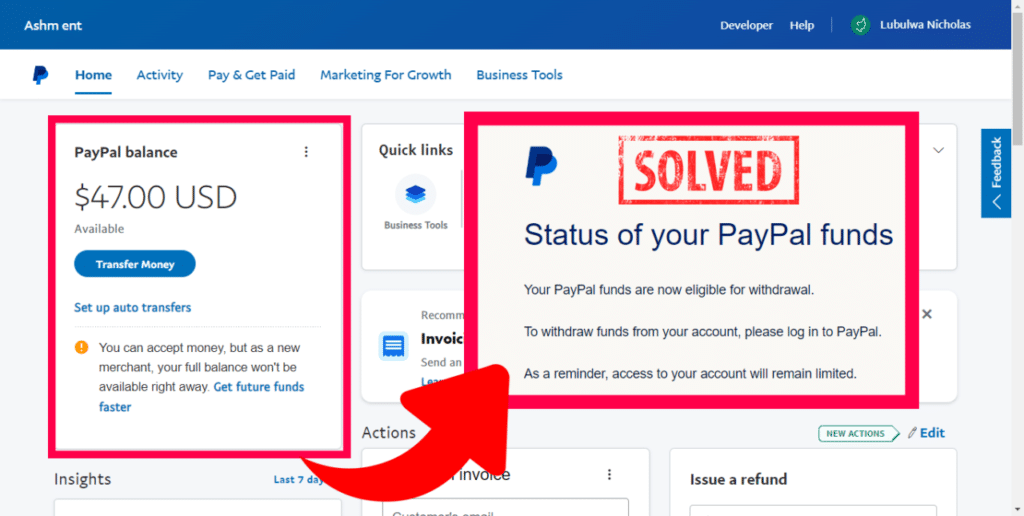

If you have a permanently limited PayPal account, follow these steps to withdraw your money:

- Log in to your PayPal account.

- Click on “Wallet” at the top of the page.

- Choose the bank account where you want to transfer the funds.

- Enter the amount you want to withdraw and click “Continue.”

- Review the details and click “Transfer.”

Ensure you provide accurate information to avoid any issues during the withdrawal process. Happy withdrawing!

How to Withdraw Money From a Permanently Limited PayPal Account?

PayPal is a widely used and convenient platform for online transactions. However, sometimes unforeseen circumstances can arise, leading to a permanent limitation on your PayPal account. This can be a frustrating situation, especially if you have funds in your account that you need to access. In this article, we will explore the steps you can take to withdraw money from a permanently limited PayPal account, ensuring that you can regain control of your funds and continue with your financial activities.

Understanding the Limitation on Your PayPal Account

Before we delve into the process of withdrawing money from a permanently limited PayPal account, it’s important to understand the reasons behind such restrictions. PayPal may limit your account for various reasons, including security concerns or violations of their terms of service. These limitations are put in place to protect users and prevent fraudulent activities.

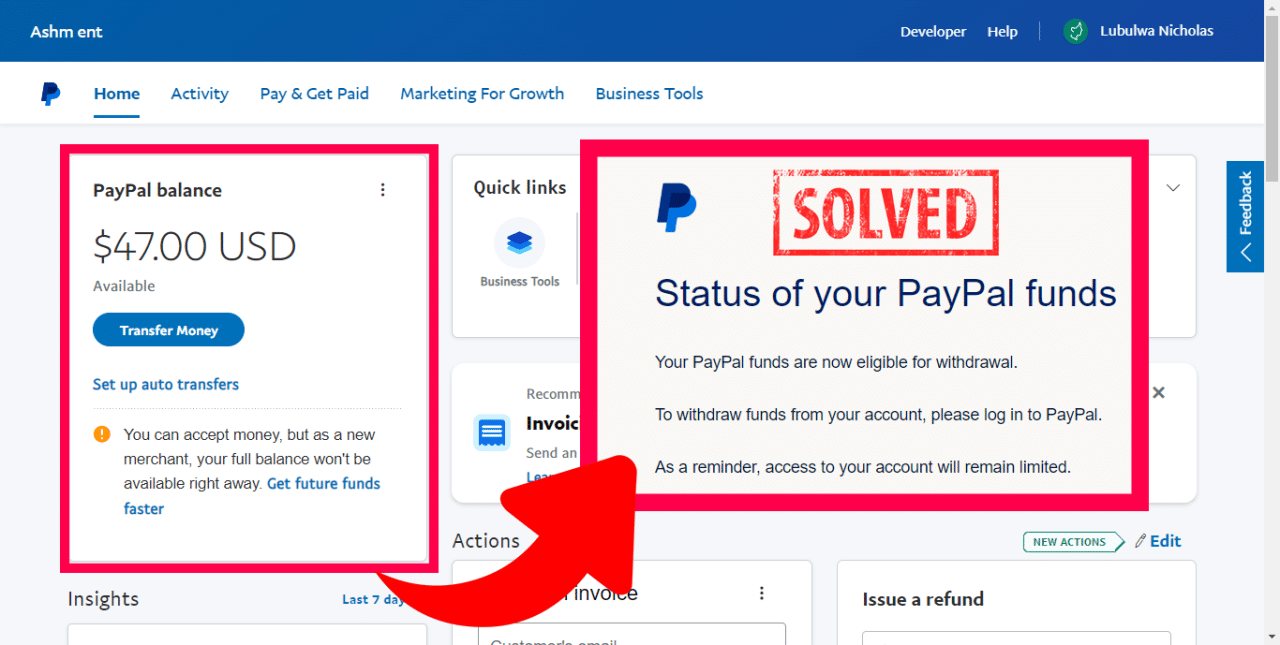

If your account is permanently limited, it means that PayPal has determined that you are no longer able to use their services. This can be due to repeated violations, suspicious activity, or failure to provide requested information or documentation during the resolution process. While this can be disheartening, there are still steps you can take to withdraw your funds.

Contacting PayPal Customer Support

The first and most important step in withdrawing money from a permanently limited PayPal account is to contact PayPal’s customer support. While your account may be limited, you may still be able to communicate with PayPal’s support team to seek assistance in accessing your funds.

When reaching out to PayPal, it is crucial to provide all relevant information and documents requested. PayPal may require you to verify your identity, provide proof of address, or answer security questions. By promptly and thoroughly complying with these requests, you increase your chances of resolving the limitation and withdrawing your funds.

Remember to communicate in a polite and professional manner with PayPal’s customer support representatives. Clearly explain your situation and express your desire to withdraw the funds from your account. Following their guidance and promptly providing any requested information will help expedite the process.

Requesting a Check or Bank Transfer

If you are unable to resolve the limitation on your PayPal account through customer support, there are alternative methods to withdraw your funds. One option is to request a check or bank transfer from PayPal.

To request a check, you will need to provide PayPal with the necessary details, such as your name and mailing address. PayPal will then generate a check and mail it to the provided address. Keep in mind that this method may take longer than other options, as it involves physical mail delivery.

If you prefer a quicker option, you can request a bank transfer. PayPal allows users to link their bank accounts, enabling direct transfers of funds. However, it’s important to note that PayPal may require additional verification steps before approving the transfer. This can include providing bank statements or verifying account ownership through small deposits or withdrawals.

Using a Third-Party Payment Gateway

If all else fails and you are still unable to withdraw funds from your permanently limited PayPal account, you may consider using a third-party payment gateway. These services act as intermediaries, allowing you to transfer funds from your PayPal account to another platform that supports withdrawal.

Before choosing a third-party payment gateway, conduct thorough research to ensure its legitimacy and reputation. Look for reviews and feedback from other users to gauge their experiences and verify the security and reliability of the platform. Additionally, review the fees and processing times associated with transferring funds from PayPal to the chosen third-party gateway.

Escalating the Issue

If you have exhausted all options and are still unable to withdraw your funds, it may be necessary to escalate the issue with PayPal further. In such cases, you can file a complaint with your country’s financial regulatory authority or seek legal advice if necessary. Additionally, consider sharing your experience with relevant online communities or forums, as others may have encountered similar difficulties and can provide guidance or insight.

Remember to remain persistent, patient, and diligent throughout the process. It can be frustrating to deal with a permanently limited PayPal account, but by adhering to the recommended steps and seeking assistance when needed, you increase your chances of successfully withdrawing your funds and moving forward with your financial endeavors. Always prioritize your own security and take appropriate measures to protect your personal and financial information throughout the process.

Additional Tips and Considerations for Withdrawing Money from a Permanently Limited PayPal Account

While tackling the process of withdrawing funds from a permanently limited PayPal account, here are a few additional tips and considerations to keep in mind:

1. Keep Records of Communication:

It’s essential to maintain thorough records of all communication with PayPal’s customer support. This includes emails, chat transcripts, or any other forms of correspondence. These records can serve as evidence in case of disputes or further escalation.

2. Check for Account Restrictions:

Before attempting to withdraw funds, ensure that there are no restrictions on the withdrawal process. PayPal may have additional limitations in place, such as minimum withdrawal amounts or specific withdrawal methods. Familiarize yourself with these restrictions to avoid any unexpected hurdles.

3. Stay Informed on PayPal’s Policies:

PayPal’s policies and terms of service can change over time. Stay updated on any changes or updates to ensure that you are aware of their current regulations and guidelines. This knowledge can help you navigate any limitations or restrictions on your account.

4. Consider Alternative Payment Methods:

If you frequently encounter issues or limitations with PayPal, it may be worthwhile to explore alternative payment methods or platforms. Research and compare different options to find a solution that suits your needs and provides a more seamless experience.

5. Protect Your Account:

Take precautions to protect your PayPal account from potential fraudulent activities or security breaches. Regularly update your password, enable two-factor authentication, and review your account activity for any suspicious transactions or unauthorized access attempts.

By keeping these tips in mind and persevering through the process, you can increase your chances of successfully withdrawing funds from a permanently limited PayPal account. Remember to remain patient, follow the necessary steps, and seek assistance when needed. With time and effort, you can regain control of your funds and continue managing your finances efficiently.

Key Takeaways: How to Withdraw Money From a Permanently Limited PayPal Account

- 1. Contact PayPal customer support for assistance.

- 2. Explore alternative payment options like linking a bank account or requesting a check.

- 3. Consider transferring funds to a trusted friend or family member’s PayPal account.

- 4. Look for peer-to-peer payment platforms that accept PayPal funds.

- 5. Keep an eye out for any updates or changes to PayPal policies regarding limited accounts.

Frequently Asked Questions

Are you wondering how to withdraw money from a permanently limited PayPal account? We have answers to your questions right here!

1. Can I withdraw money from my permanently limited PayPal account?

Unfortunately, if your PayPal account is permanently limited, you won’t be able to withdraw any funds from it. When an account is limited, it means that PayPal has placed certain restrictions on it due to various reasons, such as suspicious activity or violation of their terms and conditions. This includes money held in your account.

In such cases, PayPal will typically send you an email explaining the details of the limitation and what steps you can take to resolve the issue. It’s essential to go through the email thoroughly and follow the instructions provided. If you have any questions or need further assistance, reach out to PayPal’s customer support for guidance.

2. What can I do if my PayPal account is permanently limited?

If your PayPal account is permanently limited, there are a few steps you can take to resolve the issue. Start by checking the email PayPal sent you regarding the limitation. It should outline the exact reason for the limitation and what you can do to regain access or lift the restrictions on your account.

Typically, PayPal may ask for additional information or documentation to verify your identity or address the reason for the limitation. It’s crucial to gather the requested documents and provide them promptly. After submitting the required information, PayPal will review your case, and if everything checks out, they may lift the limitation on your account.

3. Is it possible to transfer money from a permanently limited PayPal account to another account?

When your PayPal account is permanently limited, transferring funds to another account is usually not an option. The restrictions placed on your account extend to any transactions involving the balance in your PayPal account. However, it’s worth checking the email notification from PayPal regarding the limitation, as they may provide alternative solutions or steps to follow.

If you urgently need the funds from your permanently limited PayPal account, it’s best to reach out to PayPal’s customer support and explain your situation. They may be able to offer further guidance or provide alternative solutions based on your specific circumstances.

4. Can I request a refund from a permanently limited PayPal account?

If your PayPal account is permanently limited, requesting refunds for purchases made using your account can be challenging. The limitation placed on your account restricts various functionalities, including initiating refunds. However, it’s important to contact the seller or service provider directly, explain the situation, and request a refund.

If you encounter any difficulties in obtaining a refund, you can reach out to PayPal’s customer support and explain the situation. While they may not be able to process the refund themselves, they can offer guidance on the best course of action or escalate the issue if necessary.

5. What happens to the funds in a permanently limited PayPal account?

When your PayPal account is permanently limited, any funds held in the account will typically remain there until the issue causing the limitation is resolved. PayPal may hold the funds for a certain period as they review your case or until you provide the required information and meet their conditions for lifting the limitation.

It’s crucial to follow the instructions provided by PayPal in the email notification regarding the limitation. They may require you to complete specific actions or provide necessary documentation to regain access to your funds. If you have any concerns or questions about the funds in your account, contact PayPal’s customer support for assistance.

How To Withdraw From A Permanently Limited Paypal Account To Bank Account (2022) Part 1

Summary

So, here’s what you need to know about withdrawing money from a permanently limited PayPal account. First, if your account is permanently limited, it means you have restricted access to your funds. This usually happens if there are issues with your account, like violating PayPal’s policies or suspicious activity. Second, to withdraw money, you should link a bank account to your PayPal account and then transfer the funds. Lastly, if you can’t withdraw the money yourself, you might need to contact PayPal’s customer support for assistance. Remember, it’s important to follow PayPal’s rules to avoid any limitations.

Overall, withdrawing money from a permanently limited PayPal account can be a bit tricky, but by understanding the process and seeking help when needed, you can still access your funds.