Welcome, young financial enthusiasts! Today, we’re diving into the exciting world of personal finance. So, what are the five foundations of personal finance? Let’s find out!

Picture this: You’re walking through a maze of money decisions, and the five foundations of personal finance are the map to guide you through. They are like the pillars that support a strong and secure financial future. Whether you’re saving for a new video game or dreaming of starting your own business one day, understanding these foundations is key.

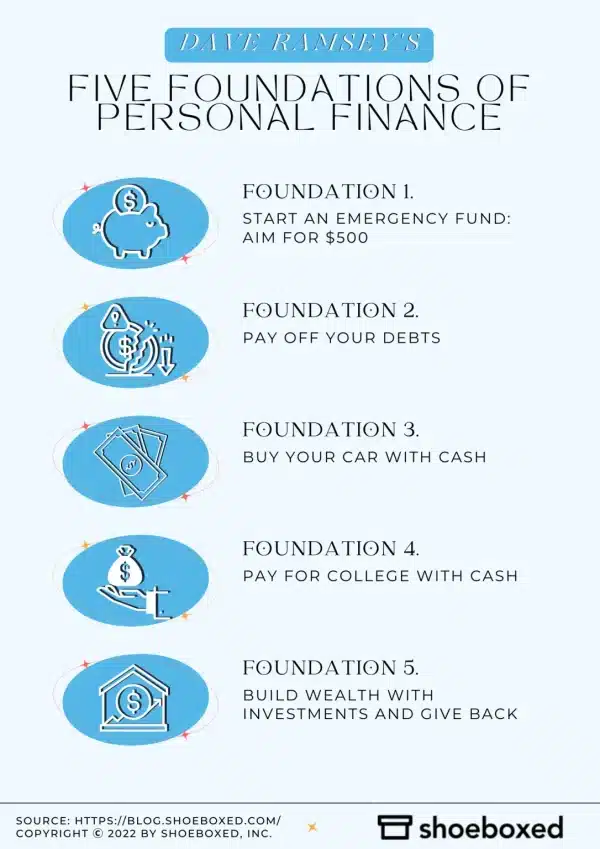

Now, you might be wondering, what are these mysterious foundations? Well, they include saving money, budgeting, managing debt, investing, and protecting yourself and your assets. Don’t worry, we’ll explore each of these in more detail in the upcoming sections, giving you the knowledge and tools to navigate your own financial journey.

So, are you ready to learn how to make the most of your money? Let’s embark on this adventure together as we uncover the secrets of personal finance and discover how these five foundations can empower you to achieve your dreams! Prepare to become a financial superhero!

When it comes to personal finance, there are five essential foundations that can help you achieve financial stability and success. These foundations include creating a budget, building an emergency fund, managing debt effectively, saving for retirement, and investing wisely. By following these principles, you can take control of your finances and pave the way for a secure financial future.

What Are the Five Foundations of Personal Finance?

When it comes to managing your personal finances, having a solid foundation is essential. The five foundations of personal finance provide a framework for building a strong financial future. From budgeting to investing, these principles guide you in making smart money decisions and achieving financial stability. In this article, we will explore each foundation in detail and understand how they can help you take control of your financial life.

The Importance of Budgeting

A budget is the foundation of personal finance. It is a plan that helps you track and manage your income and expenses. Creating a budget allows you to understand where your money is coming from and where it is going. With a budget, you can prioritize your spending, save for future goals, and avoid unnecessary debt. It gives you the power to make informed financial decisions and ensures that you have enough money for both your needs and wants.

To create a budget, start by tracking your income and expenses. List all your sources of income, including your salary, freelance work, or investments. Then, track your expenses for a month to see where your money is going. Categorize your expenses into fixed costs (rent, utilities) and variable costs (entertainment, dining out). By subtracting your expenses from your income, you can determine your monthly savings and adjust your spending accordingly. Remember, a budget is a flexible tool, so update it regularly to reflect changes in your income or expenses.

Benefits of budgeting include:

- Improved decision-making: With a budget, you can make informed choices about your spending.

- Control over your finances: A budget helps you stay on top of your finances and avoid overspending.

- Saving for future goals: By allocating funds towards your goals, you can save for things like buying a house or starting a business.

- Reduced financial stress: A budget allows you to plan for unexpected expenses and emergencies, reducing financial stress.

Building an Emergency Fund

Life is full of surprises, and having an emergency fund is crucial to handle unexpected expenses. An emergency fund is a savings account specifically for unexpected events, such as medical emergencies, car repairs, or job loss. It acts as a safety net, providing you with financial security and peace of mind when life throws a curveball your way.

Experts recommend aiming for at least three to six months’ worth of living expenses in your emergency fund. To build your fund, start by setting aside a portion of your income each month. Automate your savings by setting up automatic transfers to your emergency fund. Keep your emergency fund in a separate, easily accessible account, such as a high-yield savings account, so that you can access the funds quickly when needed.

Benefits of having an emergency fund include:

- Financial security: An emergency fund protects you from unexpected expenses and helps you avoid going into debt.

- Peace of mind: Knowing you have a safety net in place provides peace of mind and reduces financial stress.

- No reliance on credit: With an emergency fund, you won’t have to rely on credit cards or loans to cover unexpected expenses.

- Ability to seize opportunities: Having money set aside allows you to take advantage of unexpected opportunities, such as a great investment or a career change.

Debt Management and Elimination

Managing and eliminating debt is a crucial step towards a secure financial future. Debt can weigh you down and hinder your ability to build wealth. By understanding and managing your debt, you can take control of your finances and work towards a debt-free life.

Start by creating a comprehensive list of all your debt, including credit card debt, student loans, and car loans. Note down the interest rates, minimum monthly payments, and the total amount owed for each debt. Prioritize your debts based on interest rates, and consider strategies like the debt snowball or debt avalanche method to accelerate your debt repayment.

In the debt snowball method, you focus on paying off the smallest debt first while making minimum payments on the other debts. Once the smallest debt is paid off, you move on to the next smallest debt. This method provides a psychological boost as you see debts being eliminated one by one. In the debt avalanche method, you prioritize debts based on interest rates, paying off the highest interest rate debt first. This method can save you money on interest payments in the long run.

Tips for debt management and elimination:

- Create a budget and allocate extra funds towards debt repayment.

- Consider balance transfers or debt consolidation to lower interest rates.

- Avoid taking on new debt while working towards paying off existing debt.

- Seek professional help if needed, such as credit counseling or debt settlement programs.

Investing for the Future

Investing is a key foundation of personal finance that helps you grow your wealth over time. By harnessing the power of compounding returns, investing allows your money to work for you and helps you achieve long-term financial goals, such as retirement.

Before diving into the world of investing, it’s important to understand your risk tolerance, investment goals, and time horizon. Consider factors like age, income, and financial responsibilities when determining your risk tolerance. Younger individuals with more time until retirement may opt for aggressive investment strategies, while those closer to retirement may prefer more conservative approaches.

When it comes to investing, diversification is key. Diversifying your investment portfolio helps reduce risk by spreading your investments across different asset classes, such as stocks, bonds, and real estate. By diversifying, you can mitigate the impact of one investment performing poorly on your overall portfolio.

Benefits of investing for the future include:

- Building wealth over time: Investing allows your money to grow through compounding returns, helping you build wealth for the future.

- Beating inflation: Investing in assets that outpace inflation ensures that your purchasing power does not erode over time.

- Retirement readiness: By investing early and consistently, you can build a nest egg that will provide for a comfortable retirement.

- Financial freedom: Successful investing can provide you with the freedom to pursue your passions and live life on your own terms.

Insurance Coverage and Protection

Insurance plays a critical role in protecting your financial well-being against unforeseen events. It acts as a safety net, providing coverage for medical expenses, property damage, and other potential risks. Having the right insurance coverage in place ensures that you are financially protected in case of emergencies.

Start by evaluating your insurance needs, including health insurance, auto insurance, homeowner’s or renter’s insurance, and life insurance. Research different insurance options, compare coverage and premiums, and choose policies that align with your specific needs and budget.

In addition to traditional insurance coverage, consider other forms of protection, such as disability insurance or umbrella policies. Disability insurance provides income replacement in case you are unable to work due to a disability, while umbrella policies offer additional liability coverage beyond the limits of your other policies.

Tips for insurance coverage and protection:

- Regularly review your insurance policies to ensure they still meet your needs.

- Shop around for the best coverage and rates, taking advantage of discounts or bundling options.

- Consider working with an insurance agent or broker to navigate the complexities of insurance.

- Ensure that you have adequate coverage in all areas of your life to protect your assets and loved ones.

Continued Learning and Financial Education

The fifth foundation of personal finance is the commitment to continued learning and financial education. Financial literacy is essential for making informed decisions and staying up-to-date with the ever-evolving world of personal finance. By continuously educating yourself, you can adapt to changes, seize opportunities, and make sound financial choices.

There are numerous resources available to enhance your financial knowledge. Books, podcasts, online courses, and workshops are just a few examples. Seek out reputable sources and materials that cover various aspects of personal finance, such as investing, budgeting, and retirement planning.

Make financial education a lifelong habit. By staying informed and continuously learning, you can build a solid financial foundation and make empowered decisions that align with your goals and values.

Teaching Personal Finance to Children

It’s never too early to start teaching children about personal finance. By instilling good financial habits from a young age, you can set them up for a lifetime of financial success. Here are three essential lessons to teach children about personal finance:

1. The Importance of Saving

Teach children the value of saving money by encouraging regular saving habits. Help them set up a savings account and assist them in understanding the concept of setting aside money for future goals. Explain the benefits of saving, such as being able to afford things they want or having a safety net for emergencies.

2. Budgeting and Spending Wisely

Teach children about budgeting by involving them in age-appropriate financial decisions. Give them an allowance and show them how to allocate their money for different expenses, such as saving, spending, and giving. Encourage them to make wise spending choices by comparing prices and considering long-term value.

3. Delayed Gratification and Goal Setting

Teach children the value of delayed gratification and setting goals. Help them understand that not all desires can be instantly fulfilled and that patience and saving are necessary to achieve bigger goals. Encourage them to set short-term and long-term goals, such as saving for a toy or a larger purchase, and celebrate their progress along the way.

By incorporating these lessons into their upbringing, you can help children develop a strong foundation in personal finance and equip them with the tools to make smart financial decisions as they grow.

Retirement Planning: Securing Your Financial Future

Retirement planning is a crucial aspect of personal finance as it allows individuals to secure their financial future and enjoy a comfortable retirement. Here are three key steps to consider when planning for retirement:

1. Start Early and Save Consistently

The earlier you start saving for retirement, the better. Take advantage of compounding returns by investing consistently over a long period. Contribute to retirement accounts such as 401(k)s or IRAs, ensuring you maximize any employer matching contributions.

2. Determine Your Retirement Needs

Calculate your retirement expenses by considering factors such as location, healthcare costs, and lifestyle choices. Estimate how much income you’ll need during retirement and plan your savings accordingly. Keep in mind factors like inflation and increased healthcare costs when setting your retirement savings goals.

3. Diversify Your Retirement Portfolio

Diversify your retirement portfolio by investing in a mix of assets such as stocks, bonds, and real estate. Consider your risk tolerance, time horizon, and investment goals when choosing investments. Regularly review and adjust your portfolio to align with your changing circumstances and market conditions.

By starting early, calculating your retirement needs, and diversifying your retirement portfolio, you can build a solid foundation for a financially secure and enjoyable retirement.

The Five Foundations of Personal Finance for Small Business Owners

For small business owners, the five foundations of personal finance also play a critical role in the success of their business. Here’s how these foundations apply to small business owners:

1. Budgeting and Financial Planning for the Business

Just as personal budgeting is essential, budgeting and financial planning are crucial for small businesses. Create a budget that takes into account both fixed and variable expenses, as well as projected income. Continuously monitor and adjust your budget to ensure your business maintains a healthy cash flow.

2. Building Business Emergency Funds

Similar to individuals, small businesses should also have emergency funds. Set aside funds specifically for unexpected expenses or periods of low revenue. This provides a safety net and helps your business weather financial storms without resorting to excessive borrowing or accumulating debt.

3. Debt Management and Business Financing

Managing debt and making smart financing choices are essential for small business owners. Understand the different financing options available to you, such as small business loans or lines of credit. Carefully consider the terms and interest rates before taking on debt, and have a clear repayment plan in place.

4. Business Investment and Growth

Small business owners should also focus on investing in their business’s growth. This may include investing in marketing, expanding product lines, or improving infrastructure. Consider the potential returns and risks associated with each investment, making informed choices that align with your business goals.

5. Protecting the Business with Insurance Coverage

Insurance is crucial for small business owners to protect against risks and potential liability. Determine the appropriate insurance coverage for your business, including general liability insurance, property insurance, and business interruption insurance. Review your policies regularly, ensuring that they adequately protect your business’s assets and mitigate potential risks.

By applying the five foundations of personal finance to your small business, you can create a strong financial foundation and increase the chances of long-term success.

The Five Foundations of Personal Finance for Millennials

For millennials, understanding and implementing the five foundations of personal finance is especially crucial. Here’s how millennials can apply these foundations to their financial lives:

1. Budgeting and Tracking Expenses

As digital natives, millennials have access to various budgeting and expense tracking tools. Utilize personal finance apps or online budgeting tools to track your expenses and ensure you stay within your budget. Take advantage of automation features to simplify the process and save time.

2. Building an Emergency Fund

Starting to build an emergency fund early can provide millennials with a strong financial safety net. Aim to save three to six months’ worth of living expenses in an easily accessible account. Automate your savings to ensure consistent contributions towards your emergency fund.

3. Managing Student Loan Debt

Many millennials have significant student loan debt. Developing a repayment plan and exploring options like loan consolidation or income-driven repayment plans can help manage the burden. Create a budget that allows you to make your student loan payments while still saving for other financial goals.

4. Investing for Retirement

While retirement may seem distant, starting to invest early can provide millennials with a tremendous advantage due to the power of compounding returns. Take advantage of employer-sponsored retirement plans like 401(k)s and consider opening an individual retirement account (IRA).

5. Investing in Personal Development

Millennials face unique career challenges and need to invest in their personal development. This may include pursuing higher education, attending professional workshops, or acquiring new skills. Prioritize personal development investments that align with your career goals and aspirations.

By embracing the five foundations of personal finance, millennials can set themselves up for financial success and achieve their long-term goals.

Incorporating the Five Foundations of Personal Finance into Your Life

Now that we’ve explored the five foundations of personal finance and their applications in various stages of life, it’s time to consider how you can incorporate these principles into your own financial journey. Here are three steps to get started:

1. Assess Your Current Financial Situation

Begin by evaluating your current financial situation. Review your income, expenses, and any outstanding debts. Calculate your net worth by subtracting your liabilities from your assets. This assessment will provide you with a clear snapshot of where you stand financially.

2. Set Clear Financial Goals

Identify your short-term and long-term financial goals. Are you looking to save for a down payment on a house, start a business, or plan for retirement? Setting clear and achievable goals allows you to create a roadmap for your financial journey.

3. Take Action and Implement the Foundations

Implement the five foundations of personal finance into your life. Create a budget that reflects your income, expenses, and desired savings goals. Start building an emergency fund by setting aside a portion of your income each month. Develop a plan to manage and eliminate any existing debt. Consider your investment options and start taking steps towards investing for your future. Lastly, commit to continuous learning and financial education to expand your knowledge and make informed decisions.

Remember, personal finance is a lifelong journey, and your financial goals and circumstances may evolve over time. Stay proactive, regularly review and adjust your financial plans, and seek professional advice when needed.

Key Takeaways: What Are the Five Foundations of Personal Finance?

- Save a portion of your income for emergencies and future goals.

- Create a budget to track your income and expenses.

- Pay off high-interest debt to avoid unnecessary interest charges.

- Invest your savings strategically to grow your wealth over time.

- Protect your assets and loved ones with insurance coverage.

Frequently Asked Questions

In personal finance, there are five key foundations that help individuals manage their money effectively. This section answers common questions about these foundations and their importance in personal finance.

1. What is the first foundation of personal finance?

The first foundation of personal finance is saving money. This involves setting aside a portion of your income regularly for future needs and emergencies. Saving helps create a financial safety net and allows you to achieve your financial goals.

Developing a habit of saving can be done by creating a budget and cutting unnecessary expenses. It is recommended to save at least 20% of your income, but even saving a smaller amount is a good start.

2. Why is budgeting an important foundation of personal finance?

Budgeting is crucial because it helps you keep track of your income and expenses. It allows you to allocate your money wisely, ensuring that you have enough for necessities, savings, and goals. Without a budget, it’s easy to overspend and end up in debt.

Creating a budget involves listing your income and expenses, and then analyzing where you can make adjustments. It is essential to prioritize your needs and cut back on unnecessary spending to ensure financial stability and avoid living paycheck to paycheck.

3. What does it mean to have an emergency fund as one of the foundations of personal finance?

An emergency fund is a pool of money set aside specifically for unexpected expenses or emergencies. This foundation acts as a financial safety net, protecting you from debt or reliance on credit cards when faced with unplanned costs like car repairs or medical bills.

Financial experts recommend having three to six months’ worth of living expenses in your emergency fund. Start small by saving a portion of your income until you reach this goal. Once established, only use the fund for true emergencies and replenish it as soon as possible.

4. How does debt management play a role in personal finance?

Debt management is another essential foundation of personal finance. It involves effectively managing your debts, such as credit card balances, loans, and mortgages. Proper debt management helps you avoid excessive interest payments and minimizes the risk of falling into a debt trap.

Key strategies for debt management include paying bills on time, prioritizing high-interest debts, and avoiding unnecessary borrowing. Creating a repayment plan and seeking professional advice if necessary can also help you regain control of your finances and become debt-free.

5. What is the significance of investing as the final foundation of personal finance?

Investing is an important foundation of personal finance because it allows you to grow your wealth over time. By investing money in stocks, bonds, mutual funds, or real estate, you have the potential to generate returns and increase your net worth.

Investing requires understanding the risks involved and conducting thorough research. It’s crucial to diversify your investments to reduce risk, and to start early to take advantage of compounding returns. While investing carries some level of risk, it is a key strategy to protect against inflation and work towards long-term financial goals.

What are the 5 Foundations of Personal Finance?

Summary:

Managing money means making smart choices about how to save, spend, and invest. Personal finance is all about taking control of your financial future. The five foundations of personal finance can help you build a strong financial foundation: Save money, spend wisely, borrow carefully, invest for the future, and protect your wealth.

In order to achieve financial success, it’s important to make saving a priority. By setting aside money regularly, you can build an emergency fund and save for bigger goals. It’s also crucial to spend your money wisely, avoiding unnecessary expenses and prioritizing your needs. When it comes to borrowing, make sure to borrow responsibly and only take on debt that you can manage. Investing is another key aspect of personal finance, helping your money grow over time. Finally, protecting your wealth through insurance and estate planning is essential for a secure financial future. By following these five foundations, you can take control of your money and achieve your financial goals.