Looking to use Snap Finance online? You’ve come to the right place! With Snap Finance, you have a world of possibilities at your fingertips, ready to be explored. Whether you’re eyeing a new gadget, craving a stylish wardrobe upgrade, or dreaming of a vacation, Snap Finance is here to help you make it happen. So, buckle up and get ready to discover the exciting world of Snap Finance online!

When it comes to where you can use Snap Finance online, the options are endless. From popular retailers to specialty stores, you’ll find plenty of places that accept Snap Finance as a payment option. Want to shop for the latest tech gadgets? Snap Finance has you covered with partner stores like Best Buy and Amazon. Need to revamp your wardrobe? Check out fashion-forward retailers such as Forever 21 or H&M. The best part? You can explore all these options without leaving the comfort of your home!

Not only can you use Snap Finance for shopping, but it also extends its reach to other areas of your life. Want to take that dream vacation but don’t have the funds upfront? Snap Finance allows you to book flights and accommodations through its travel partners. So, whether you’re looking to buy, explore, or experience something new, Snap Finance is your go-to online companion. Get ready to dive into a world of convenience, flexibility, and endless possibilities!

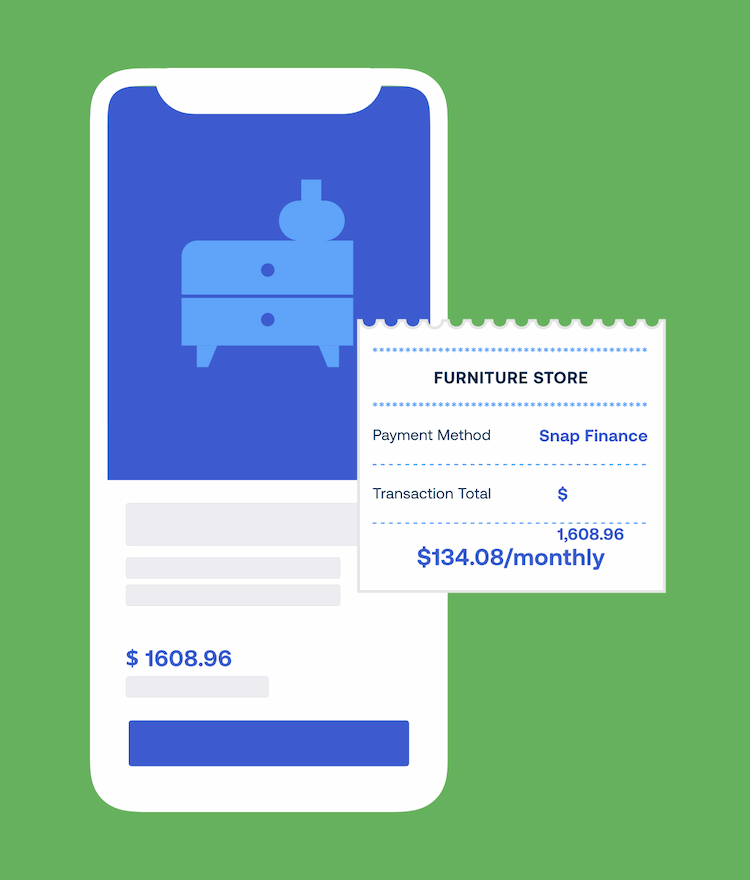

Looking to use Snap Finance online? Snap Finance can be used at a variety of online retailers. With Snap Finance, you can shop for furniture, electronics, appliances, and more. Simply search for online stores that accept Snap Finance as a payment option at checkout. Enjoy the convenience of shopping online and using Snap Finance to finance your purchases!

Where Can I Use Snap Finance Online?

Welcome to our comprehensive guide on where you can use Snap Finance online! If you’re looking for a convenient and flexible way to finance your purchases, Snap Finance is a fantastic option. With a wide network of online retailers, you can use Snap Finance to make your shopping experience even more enjoyable. In this article, we will explore the various places where you can utilize Snap Finance online and provide you with all the information you need to make the most of this financing solution. Let’s dive in!

1. Online Retailers

One of the primary places where you can use Snap Finance online is at a variety of online retailers. Snap Finance has partnered with numerous e-commerce businesses across different industries that accept Snap Finance as a payment option. Whether you’re in search of trendy fashion, electronics, furniture, or home goods, you’ll likely find online retailers that offer Snap Finance as a payment method. By using Snap Finance, you can shop for your desired products on these websites and pay for them in manageable installments, making it easier on your wallet.

When shopping at these online retailers, you’ll typically find the Snap Finance option at the checkout page. Simply select Snap Finance as your payment method, and you’ll be prompted to apply for financing. After completing the application process and being approved, you can finalize your purchase and enjoy your new products without the stress of paying everything upfront.

Some popular online retailers that accept Snap Finance include fashion websites, such as Fashion Nova and Boohoo, tech retailers like Newegg and iBuyPower, and home goods stores like Overstock and Ashley HomeStore. The list is continuously expanding, so you can explore different online retailers and find the ones that align with your shopping preferences and needs.

2. Online Marketplaces

In addition to online retailers, Snap Finance can also be used on various online marketplaces. Online marketplaces are platforms that connect buyers and sellers, allowing for a wide range of products to be bought and sold. These platforms often provide a secure environment for transactions and offer a vast selection of items from different sellers.

Platforms like eBay and Etsy have partnered with Snap Finance to offer financing options to their customers. This means that when you find a product you love on these marketplaces, you can opt to use Snap Finance at the checkout. Whether you’re looking for vintage collectibles, handmade crafts, or unique items, financing your purchase with Snap Finance can make the process more affordable and convenient.

Using Snap Finance on online marketplaces follows a similar process to that of online retailers. Once you reach the payment stage, choose Snap Finance as your payment method, and complete the application and approval process. Once approved, you can proceed with purchasing the desired item and enjoy the benefits of financing.

3. Online Travel Agencies

Did you know that Snap Finance can also be utilized for travel expenses? Yes, you heard it right! Snap Finance partners with select online travel agencies, making it possible for you to finance your travel plans. Whether you’re thinking of booking a flight, reserving accommodation, or planning an entire vacation package, Snap Finance can be a convenient option to manage your travel costs.

Many online travel agencies offer the option to pay for your trips in installments, and Snap Finance can make this option more accessible to a wider range of customers. By using Snap Finance, you can spread out the cost of your travel expenses over several months, making it easier to budget for your dream vacation.

Next time you’re planning your next getaway, check if the online travel agency you choose accepts Snap Finance. Some popular travel platforms that work with Snap Finance include CheapOair, Expedia, and Priceline. Remember to review the terms and conditions related to using Snap Finance for travel expenses and make sure it aligns with your financial situation and goals.

Tips for Using Snap Finance Online

Now that you’re aware of the various places where you can use Snap Finance online, here are some essential tips to ensure you have a smooth and enjoyable experience:

1. Check Your Eligibility

Prior to making a purchase using Snap Finance, it’s important to check your eligibility. Snap Finance has certain requirements and criteria that applicants must meet to be approved for financing. These criteria may include a minimum age limit, employment status, and other factors. By reviewing the eligibility requirements beforehand, you can increase your chances of being approved and avoid any potential disappointment.

2. Compare Offers

Just like any other financial decision, it’s always a good idea to compare offers from different retailers or online platforms. Look for the best interest rates, repayment terms, and other features that align with your preferences and needs. By comparing offers, you can make an informed decision and select the option that provides the most value.

3. Budget and Plan

Utilizing Snap Finance online is an excellent way to make your purchases more manageable, but it’s still important to budget and plan accordingly. Create a budget that takes into account your monthly installment payments and ensure that you have the financial means to meet those obligations. By budgeting and planning, you can enjoy the benefits of Snap Finance without encountering any financial challenges along the way.

4. Read the Fine Print

Before applying for Snap Finance or making any purchases, it’s crucial to read and understand the terms and conditions. Pay attention to interest rates, fees, repayment schedules, and any other relevant information. Being well-informed will help you make confident decisions and prevent any surprises or unexpected costs.

Conclusion

Snap Finance offers a convenient and flexible financing solution for online purchases. Whether you’re shopping at popular online retailers, browsing through online marketplaces, or planning your next trip with an online travel agency, Snap Finance provides an accessible way to finance your expenses. Remember to check your eligibility, compare offers, budget and plan accordingly, and read the fine print. By following these tips, you can make the most of Snap Finance and enjoy a seamless online shopping experience.

Key Takeaways: Where Can I Use Snap Finance Online?

- Snap Finance can be used online for various purchases, such as electronics, furniture, and other retail items.

- Many online retailers accept Snap Finance as a payment option, allowing you to shop conveniently from the comfort of your home.

- You can use Snap Finance online to finance your purchases and pay them off in manageable installments.

- Before using Snap Finance online, make sure to check if your desired retailer accepts this payment option.

- Snap Finance online provides flexibility and convenience for those looking for alternative financing options.

Frequently Asked Questions

Welcome to our FAQ section on using Snap Finance online! If you’re looking to find out where you can use Snap Finance for your online purchases, you’ve come to the right place. Below are some commonly asked questions and answers to help guide you through your Snap Finance online experience.

1. Can I use Snap Finance online for any type of purchase?

Yes, you can use Snap Finance online for a wide range of purchases. Whether you’re shopping for electronics, furniture, appliances, or even fashion, Snap Finance partners with various online retailers to offer you the financing you need. From big-ticket items to everyday essentials, Snap Finance has you covered.

Just browse through the websites of Snap Finance’s retail partners and look for the Snap Finance logo or payment option at checkout. Once you select Snap Finance as your payment method, you can apply for instant financing and complete your purchase without any hassle.

2. Are there any restrictions on the items I can purchase using Snap Finance online?

While Snap Finance allows you to finance a wide range of items online, there may be some restrictions depending on the retailer’s policies. Certain high-risk products, such as firearms, tobacco, or adult content, may not be eligible for financing through Snap Finance.

However, you can always check with the specific online retailer or contact Snap Finance directly to get a comprehensive list of approved items. Snap Finance strives to provide options that meet the needs of a wide range of customers, ensuring you can find financing solutions for most of your online purchases.

3. Can I use Snap Finance online if I have bad credit?

Yes, one of the advantages of Snap Finance is that it caters to individuals with less-than-perfect credit scores. Snap Finance considers factors beyond just credit history, giving you the opportunity to qualify for financing even if you have bad credit.

When you apply for Snap Finance online, they take into account your income, spending habits, and ability to repay the loan. This alternative approach to credit assessment increases your chances of approval, making Snap Finance a great option for those with bad credit.

4. How do I apply for Snap Finance online?

To apply for Snap Finance online, the process is simple and straightforward. Start by visiting the website of one of Snap Finance’s retail partners. Browse through the available products and add the items you wish to purchase to your cart.

At checkout, select Snap Finance as your payment option, and you will be redirected to the Snap Finance application page. Fill out the required information, including your personal details, income, and banking information. Once you submit your application, you will receive an instant decision, allowing you to complete your purchase if approved.

5. Can I use Snap Finance online for international purchases?

Currently, Snap Finance is available for use within the United States only. While some online retailers may offer international shipping, their partnership with Snap Finance for financing options may be limited to U.S.-based customers. It’s important to check with the specific retailer or Snap Finance to see if international purchases are eligible for financing.

If you’re an international customer, exploring local financing options or reaching out to international financing providers may be a suitable alternative to Snap Finance for your online purchases.

Where can I use snap finance?

Summary

If you’re wondering where you can use Snap Finance online, you’re in luck! Snap Finance provides a simple way to finance your purchases at various online retailers. You can shop for a wide range of products, from furniture to electronics, and use Snap Finance to pay over time. It’s easy to apply, and you can get approved even if you have bad credit. Just make sure to read the terms and conditions, and remember to make your payments on time to avoid any late fees. Happy shopping!

In conclusion, Snap Finance makes it possible for you to shop online and pay later. With their easy application process and approval for bad credit, you can enjoy the flexibility of financing your purchases. Just make sure to understand the terms and make your payments on time. So go ahead, find your favorite online store that accepts Snap Finance and start shopping!